- 1Retirement

- 2Inheritance

- 3Care costs

- 4Investments

Inheritance planning

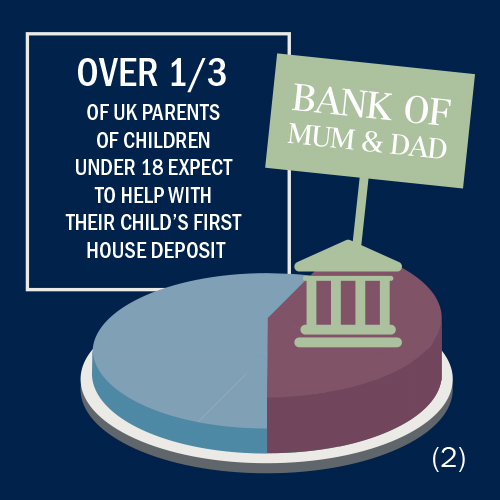

The right arrangements will support your next generation, whether you're hoping to fund their education, help with a house deposit or just see them alright.

Use this step to calculate how much inheritance tax (IHT) could reduce the amount you leave behind.

- Spend it or give it away – this is the simplest and easiest option. If you give it away, you have to survive for seven years after the date of the gift, or it will still be included in your estate after all. Remember, it's important not to give everything away though, as you still have to live yourself

- Give away any excess income – any unspent income each month is simply increasing the size of your estate. Instead, distribute it among family, friends or charities – or use it to pay for life cover

- Arrange life cover – the premium and amount of cover will normally be fixed, giving you control of your estate rather than having to make substantial gifts. You can use an annual allowance or unspent income to fund the cost of cover

- Set up trusts – this is important if you don't want to lose control of your capital. Some trusts will pay a fixed level of income, while others can offer your beneficiaries additional benefits, such as protection against divorce or bankruptcy

- Set up specialist investments – you can invest in a range of permitted UK companies and achieve IHT exemption after only two years. This is a higher-risk approach than the options listed above, but it offers quick relief, you don't have to give any assets away, and you'll have ongoing access to your capital.

IHT rules are complicated and no one likes thinking about their own mortality, but the implications of not making arrangements could be significant for your family. A little IHT planning could build your confidence in their financial future.

The tax treatment of all investments depends upon individual circumstances and the levels and basis of taxation may change in the future. Investors should discuss their financial arrangements with their own tax adviser before investing.

Typically, companies whose shares may be eligible for IHT relief should be regarded as high risk and are not suitable for all investors.

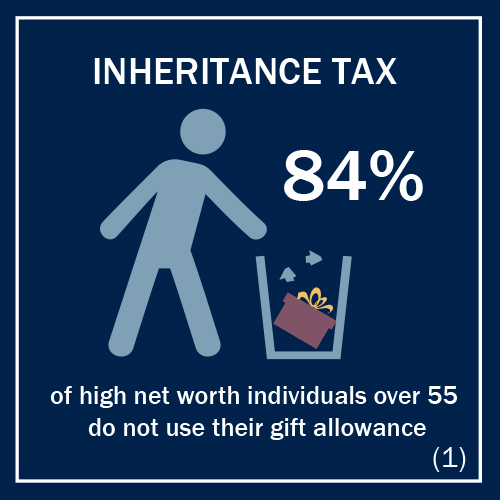

(1) Source: 84% IHT trash can: Survey conducted by YouGov on behalf of Canaccord Genuity Wealth Management. Total sample size was 2,011 adults, of which 1,091 were workers aged 18-64 and 265 have £100k+ of investable assets. Fieldwork was undertaken between 10 - 11 Aug 2016. The survey was carried out online. The figures have been weighted and are representative of all GB adults (aged 18+).

(2) Source: Over 1/3 cake: Ali, A. (2015) – Parents ‘concerned’ their children will be in debt as cost of higher education and living rise. Independent [accessed July 2017].

*Certain investments and charitable donations may be exempt

Calculate your inheritance tax

IHT is payable on the value of anything you leave behind when you die. The standard rate is 40% and is due on any amount above £325,000 for an individual.

*This assumes that you aren't entitled to the residence nil-rate band, that your assets will not qualify for business relief, that you have not made any gifts in the last seven years, and your estates do not qualify for a reduced IHT rate of 36%. Our experts can advise on where the reduced rate may apply.

The tax treatment of all investments depends upon individual circumstances and the levels and basis of taxation may change in the future. Investors should discuss their financial arrangements with their own tax adviser before investing.