A Strong and Complementary Combination

- Bringing together two of the largest and longest-standing independent wealth management businesses in Canada would create the preeminent independent wealth management business in Canada

- Combined AUA would be over $60 billion with significant growth potential on a proven platform

- Strong commitment to clients and well-positioned to serve the complex needs of Canada’s most successful entrepreneurs, ultra/high-net worth investors as well as a diverse population of private clients

- Unbiased product offering, freedom to do what is best for their clients

Significant advantages for Investment Advisors and their Clients

- Richardson Wealth advisors can grow their businesses faster and more sustainably on CG’s platform

- More than six consecutive years of substantial profitability gains has given Canaccord Genuity a significant head start in investing to advance its technology and product offering. Investment Advisors and their clients benefit from a state-of-the-art integrated UMA platform powered by Envestnet, enhanced investment & advisory solutions, wealth, estate & tax planning, practice management, marketing support, and digital private placement capabilities

- CG is a leading equity underwriter in Canada. Close collaboration between CG Capital Markets and Wealth Management provides considerable ECM opportunities that may not be available at RF Capital or bank-owned dealers

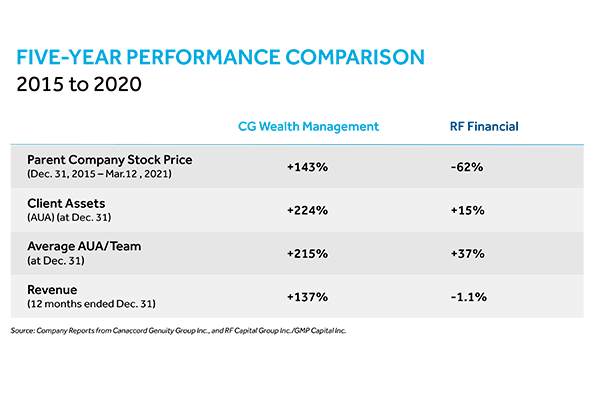

CG’s Proven Track Record of Creating Substantial Value in the Wealth Management Segment

- Over the past decade CG has invested more than$350 million in acquisitions, recruiting, and technology to support the growth of its wealth management businesses in Canada, the UK & Crown Dependencies and Australia. The combined business would benefit from this investment in value creation

- Canaccord Genuity Wealth Management has consistently delivered growth and profitability through a range of market environments. Firmwide client assets have grown steadily and substantially for more than six consecutive years, from C$32 billion in 2015 to C$88 billion in 2021 (as at February 28, 2021)

- CG has a proven track record of successfully integrating new IAs and acquisitions across our wealth management operations

The Value Proposition is Clear

- The Proposal at $2.30 per share values 100% of RFC equity at approximately $367 million and aligns with the formal valuation commissioned by the Special Committee of RFC’s Board of Directors in connection with the recently completed RGMP transaction, which resulted in a valuation range of $2.00-$2.55/per share.

- The Proposal represents a 30% premium to the VWAP for the 20 trading days ended on March 12, 2021

- The Offer provides RFC shareholders – including Richardson Wealth IAs - an opportunity to participate in the ongoing success of Canaccord Genuity and the additional value of the combined wealth management business in Canada

- Substantial synergies and economies of scale would be accretive to CG earnings

The information in this portion of the web site is intended for use by persons resident in Canada only. Canaccord Genuity Wealth Management is a division of Canaccord Genuity Corp., Member - Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. Independent Wealth Management advisors are registered with IIROC through Canaccord Genuity Corp. and operate as agents of Canaccord Genuity Corp.