- Home

- News and insights

- Take the long view: why staying invested is better than moving to cash

Take the long view: why staying invested is better than moving to cash

As an investor, you face a constant ‘stick or twist’ dilemma: should you stay invested in your chosen assets (stocks, shares, property etc) or should you opt for the safety of cash (usually a deposit or savings account)?

Currently we are all being bombarded with negative news headlines about the effects on our investments of COVID-19, Brexit, mini budgets and worldwide political unrest – and of course this has an impact on our investing mindset. Cash is also looking more attractive at the moment as, after 15 years where rates have been very close to (or at) zero, for the time being, returns are credible.

However, so far banks are proving glacial at passing on the Bank of England base rate (5.25% at the time of writing). Even the best UK deposit rates are still providing a negative real return (i.e. the return after October’s most recent inflation point of 4.6% is deducted). We encourage you to double-check what your bank is paying you.

The decision whether to ‘stick or twist’ can be influenced by a myriad of factors but is fundamental to financial success. While the allure of cash in times of uncertainty is undeniable, a well-considered decision to stay invested often proves the wiser choice. In this article, we will explore why.

1) Invest for the long term – growth potential

One of the most compelling reasons to stay invested is the long-term growth potential of assets. Historically, stocks and other investment vehicles have consistently outpaced the rate of inflation and provided substantial returns over extended periods. By staying invested, you can harness the power of compound interest, which can significantly multiply your initial investments over time, giving them the potential to grow exponentially over the long term.

For example, if you had invested in the Canaccord Genuity Risk Profile 4 strategy at its inception on 31 July 2004, your investment would have returned 163.7% to end November 2023. This return has significantly outpaced inflation and (even more dramatically) the performance of cash (39.1%*), despite the multiple market downturns during this period (the Great Recession, the European debt crisis and COVID-19). This shows the potential for substantial wealth creation if you stay invested for the long haul.

*Source: Sterling Overnight Index Average (SONIA)

Cash simply does not benefit from the same compounding effect as long-term investments.

Take 90 seconds to find out how inflation is eroding the real value of cash savings.

2) Attempting to time the market consistently is pointless

Trying to time the market by moving to cash during downturns and re-entering during upswings is a strategy fraught with challenges. Even the best-seasoned professionals struggle to make consistently accurate market timing decisions. It’s arguably why the greatest investor of our time, Warren Buffett, says he has only made 12 ‘truly good’ investment decisions across his lifetime.

The emotional rollercoaster of trying to predict market movements often leads to poor outcomes, as investors may sell during a dip only to miss out on subsequent gains, or stay in cash during a rising bull market, missing out on profits.

The adage ‘time in the market, not timing the market’ encapsulates the wisdom of staying invested. Investors who maintain their positions through market fluctuations are better positioned to capture the long-term growth trends.

At CGWM, we believe asset allocation drives the majority of returns, and using this framework forces us to confront tough investment decisions during both bullish and more difficult markets. It also reassures our clients with known positioning.

3) Diversification reduces risk

We also believe that diversification is a cornerstone of prudent investing. By spreading investments across various asset classes, sectors and themes, we can reduce the risk associated with market segments. Staying invested enables the maintenance of a diversified portfolio, which acts as a protective shield during market volatility.

Diversified portfolios tend to have a smoother performance trajectory, as gains in some assets can offset losses in others. This risk-mitigating effect becomes especially valuable during economic downturns, when specific sectors may underperform.

4) The opportunity costs – and even dangers – of holding cash

While cash provides safety and liquidity, it also comes at a cost, as it effectively locks in the opportunity cost of potential returns from other assets. Despite rates being at their highest level since 2007, the real return on cash remains negative after accounting for inflation, so it is still eroding purchasing power over time.

That’s why one of the key pillars in our CGWM investment framework is inflation. We encourage our clients to stay invested with us for the long term and are convinced that the best opportunity to maintain the real value of your wealth over that period is through investments.

It is also true that some of the banks that publish the highest and most attractive rates have a lower quality credit rating (from official rating agencies such as Moody’s, Fitch and Standard & Poor’s). Although no deposits were lost (and in the UK we have our own £85,000 FSCS protection limit) earlier this year, we saw the panic in financial systems during the regional bank failures in the USA.

5) The psychological benefits of staying invested

Investing can be an emotionally taxing experience, especially during periods of market turbulence. Staying invested helps investors overcome the common behavioural biases, such as fear and greed, that can lead to poor investment decisions. A well-structured investment strategy with a focus on long-term goals can help investors weather market storms with confidence.

At CGWM, we publish multiple benchmarks (relative comparison indexes as well as our peer group returns). Furthermore, we encourage clients with a tailored solution and/or an adviser to stay in contact for regular updates and portfolio discussions. We believe it’s essential to create informed investors by educating our clients.

6) Tax considerations

Taxes can significantly impact your investment returns. When you sell assets, you may incur capital gains taxes, which can erode a significant portion of your profits. By staying invested and deferring the realisation of capital gains, you can potentially reduce your tax liabilities.

Other investments, such as the UK gilts position we hold for many clients, can benefit from beneficial tax treatment. Although our chosen investment’s anticipated return is just under 5%, the equivalent return required for a higher-rate tax payer would be north of 8%.

7) Economic recovery and growth

Historically, financial markets have demonstrated resilience and the ability to rebound from economic downturns. While market crashes and recessions are inevitable, they are typically followed by periods of recovery and growth. Staying invested allows you to participate in the economic rebound and benefit from the potential upside.

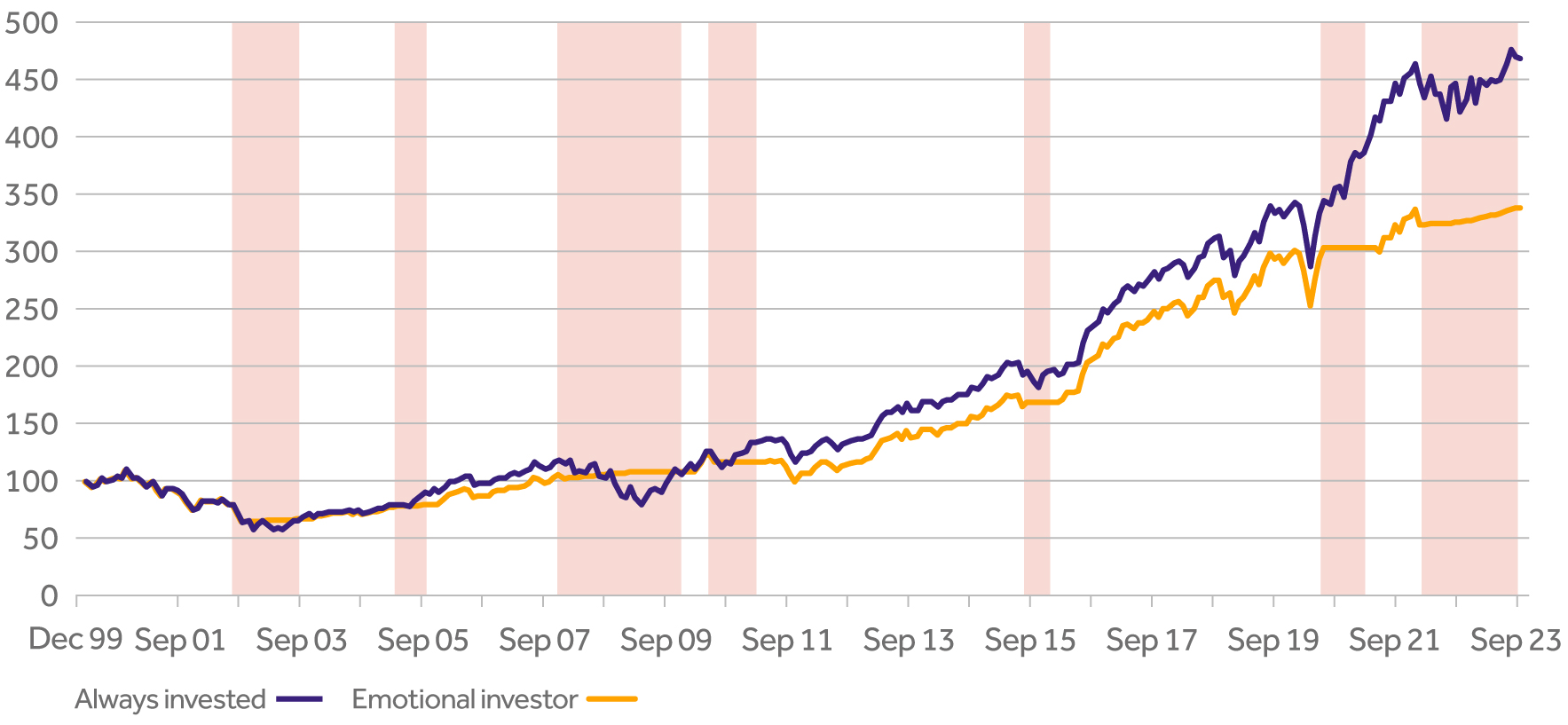

The chart below shows how a long-term fully invested portfolio (the blue line) has performed since the millennium, when compared with an ‘emotional’ strategy (the red line), where the investor has switched to cash when they are worried about falling markets.

- Blue = fully invested in the global equity market (FTSE All-World TR GBP Index)

- Orange = investments shift to cash for six months when the American Association of Individual Investors (AAII) bull to bear ratio reaches 0.6 – the level at which investors start to feel nervous

- Red bars represent periods of low investor sentiment.

Sources: Bloomberg and CGWM.

Sources: Bloomberg and CGWM.

Conclusion

Staying invested is often a more rational and lucrative choice than moving to cash. This decision is supported by all the reasons discussed above, including the long-term growth potential, the benefits of diversification, and the likelihood of economic recovery. While we recognise the need to hold some cash in savings – in case of emergency, or for planned short-term expenditure – when thinking about long-term growth, staying invested is, in our opinion, the sensible choice.

That said, it's crucial to have a well-thought-out financial plan, maintain a diversified portfolio, and periodically reassess your investment strategy to make sure it is still aligned with your financial goals and risk tolerance. By doing so, you will be able to navigate the unpredictable waters of the financial markets with confidence, knowing that your decision to stay invested is grounded in sound financial principles.

Ask us how we can help you make the most of opportunities

If you’d like to know more about the advantages of long-term investment, and discuss how you could benefit from our investment expertise and philosophy, please get in touch with us.

You may also like…

Need more help?

Whatever your needs, we can help by putting you in contact with the best expert to suit you.

American Association of Individual Investors bull-to-bear ratio

The American Association of Individual Investors (AAII) conduct a weekly Investor Sentiment Survey that provides insight into the opinions of individual investors by asking them their thoughts on where the market is heading over the following six months. The output ratio shows the percentage of investors who are market bullish, bearish or neutral on stocks.

Asset allocation

Asset allocation is the term used to describe how investors divide their portfolio across different general asset classes (e.g. Fixed Income, Equities, Alternatives and Cash).

Bull and bear markets

A bull market occurs when asset prices rise significantly over a sustained period, while a bear market is defined by a prolonged drop in asset prices.

Investor sentiment

Investor sentiment (or market sentiment) is the overall attitude of investors toward a specific market, sector or asset. It suggests their enthusiasm for, or pessimism about, investing in that area, and is reflected in market movements. If investors are feeling ‘bullish’, asset prices will rise. If they are ‘bearish’, investor sentiment is low, and prices will fall.

Known positioning

Each client of CGWM has an agreed asset allocation framework, with tactical tolerance bandwidths around each holding. This can be tailored to each client and is changeable should the client wish for a different risk profile.

UK gilts

Gilts are government bonds in the UK, similar to US Treasury bonds. The term gilt describes a bond with a low risk of default and a low rate of return, and the name comes from historical certificates with gilded edges issued by the British government.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

This is not a recommendation to invest or disinvest in any of the companies, themes or sectors mentioned. They are included for illustrative purposes only.

The information contained herein is based on materials and sources deemed to be reliable; however, Canaccord Genuity Wealth Management makes no representation or warranty, either express or implied, to the accuracy, completeness or reliability of this information. Canaccord is not liable for the content and accuracy of the opinions and information provided by external contributors. All stated opinions and estimates in this article are subject to change without notice and Canaccord Genuity Wealth Management is under no obligation to update the information.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.