- 1Retirement

- 2Inheritance

- 3Care costs

- 4Investments

Should you care about care home costs?

One in four of us may need someone to look after us in old age, either at home or in a care home.

However, the state does not cover care costs, and the NHS will not necessarily pay for dementia care or other needs that are considered part of the ageing process.

Use this step to decide if you could afford the cost of care in later life.

Did you know?

- 44% of all people receiving care have to fund it entirely themselves

- Publicly funded social care is means-tested – you'll only get help if you have less than around £23,250 in assets (often including the value of your home)

- A care home can cost over £30,000 a year and care at home over £10,000, rising to £30,000 or more, depending on how much care you need

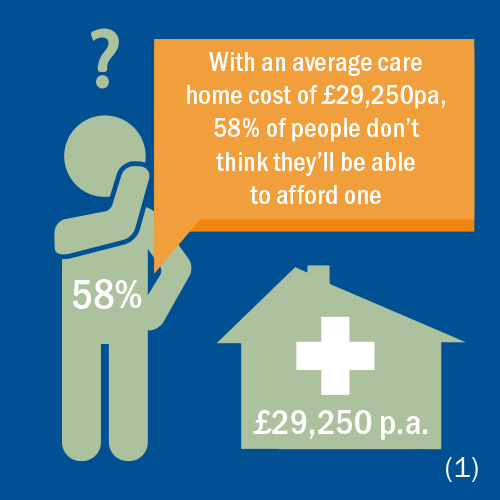

- On average, you can expect to pay around £29,250 a year in residential care costs, rising to over £39,300 a year if nursing care is necessary

- By 2025, 1.14 million people are expected to be living with dementia

- An estimated 4 million older people in the UK have a limiting long-standing illness.

It's possible to structure your finances to accommodate care home costs while maintaining your capital tax efficiently for inheritance purposes. However, we would always recommend talking to a qualified financial planner to ensure you take advantage of all the tax-efficient ways you can structure your investments, which might include a care home annuity and/or an inheritance tax portfolio.

The tax treatment of all investments depends upon individual circumstances and the levels and basis of taxation may change in the future. Investors should discuss their financial arrangements with their own tax adviser before investing.

This service should be regarded as high risk as it is exclusively focused on equities. The portfolios are wholly invested in small capitalisation stocks. These companies are therefore more volatile and whilst they offer great potential, growth is not guaranteed.

(1) Source: Question mark man/don’t think they’ll be able to afford one: Survey conducted by YouGov on behalf of Canaccord Genuity Wealth Management. Total sample size was 2,011 adults, of which 1,091 were workers aged 18-64 and 265 have £100k+ of investable assets. Fieldwork was undertaken between 10 - 11 Aug 2016. The survey was carried out online. The figures have been weighted and are representative of all GB adults (aged 18+).

(2) Source: Pay for own care home/money box: Saga (2016) – What you need to know about care home fees [accessed July 2017].

Can you afford the cost of later life care?

A care home can cost over £30,000 a year and care at home over £10,000, so earmarking money for care could give you greater peace of mind and enable you to choose your preferred option.

If completing this step has raised your concerns about paying for care, please talk to a qualified financial planner to see if you could put some plans in place to help here.