- 1Retirement

- 2Inheritance

- 3Care costs

- 4Investments

- 4Investments

Investment management

To have confidence in your financial future, it’s important to know how your money is being invested so that it meets your objectives and you don’t take unnecessary risks – no matter whether you use a wealth manager, bank, IFA or self-invest through an online investment platform or in property.

Use this step to decide if your money is being invested and managed properly.

There are various factors which can give you the confidence that your money is being invested and managed effectively. How many can you answer positively – or should you find someone to do it better?

- Your investments are performing well and/or providing you with acceptable returns for the risks you are taking

- You're happy with the types of investment you and/or your adviser have chosen – such as equities or bonds, property or pensions, or a fully diversified portfolio – and you understand the possible risks and returns from each

- You and your wealth manager have a clear understanding of your wealth goals

- You have a strong relationship with your professional wealth manager – they keep you informed on a regular basis and you can have a regular review meeting

- You feel in control of where your money is being invested or you trust your wealth manager to do this for you

- Your wealth manager is a qualified expert who is actively managing your investments.

What other people said about investment management

Between 30 August and 8 September 2017, YouGov interviewed 541 people who have £750,000 or more in investable assets, asking them a series of online questions about their confidence in their advisers and their future.

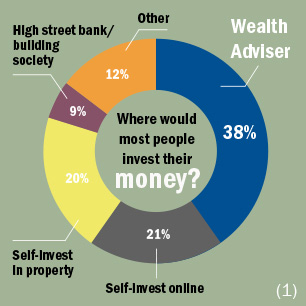

When they asked people how they invest the majority of their money, 9% said they invest through high street banks or building societies, although confidence in their ability was low with 50% believing they could actually do a better job at investing than those very same banks.

Confidence in wealth management services was much higher because, of those people using a wealth manager/private bank, just 5% thought they could do a better job of managing their investments.

High street banks and building societies were also criticised for not understanding their clients’ financial goals, with 55% of respondents who use them thinking their grasp of their clients’ situations was poor.

Again, confidence in IFAs and wealth managers was much higher among their users, with 93% and 91% (respectively) believing they had a clear understanding of their financial goals.

21% of those surveyed said they invest the majority of their money in online-only investment platforms. By comparison, most wealthy people – at 38% – invest the majority with their wealth manager/IFA.

(1 & 2) Source: Wealth adviser/doughnut and also 9 out of 10 people etc: Survey conducted by YouGov on behalf of Canaccord Genuity Wealth Management. Total sample size was 2,011 adults, of which 1,091 were workers aged 18-64 and 265 have £100k+ of investable assets. Fieldwork was undertaken between 10 - 11 Aug 2017. The survey was carried out online. The figures have been weighted and are representative of all GB adults (aged 18+).

Are your investments being managed properly?

If completing this step has raised your concerns about how your money is being invested and managed, please talk to a qualified wealth manager to see if you could improve your situation.