- Home

- Investment solutions

- Investment funds

- Specialist funds

Specialist funds

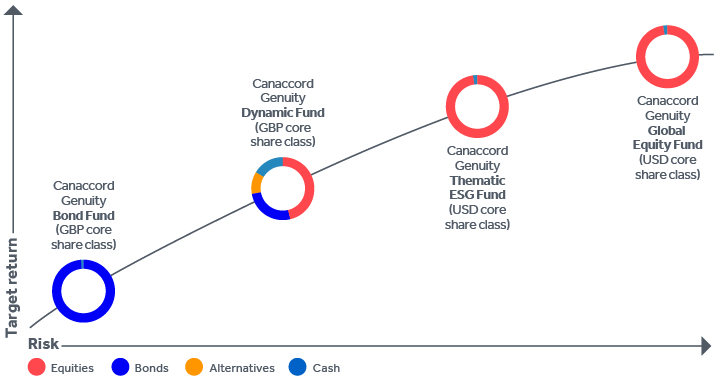

We also have a range of funds which offer dedicated exposure to bonds and global equities.

This fund is designed to generate positive total returns from a diversified portfolio of bonds, other debt securities, collective investment schemes and money market instruments, with a bias towards sterling denominated assets.

In normal circumstances, the fund will aim to deliver income in excess of the average rate achievable through a one-year cash deposit.

As well as its core sterling share class, the Canaccord Genuity Bond Fund is available in euro, Swiss franc, Australian, Canadian, Singapore and US dollar hedged share classes.

This fund is appropriate if your clients are seeking growth over the longer term.

With an equal emphasis between capital growth and preservation of capital, this fund has built a solid long-term track record by adopting an active and dynamic approach to both asset allocation and security selection.

It primarily adopts a top-down approach, with a starting asset allocation split equally between return seeking assets such as equities and more defensive securities such as government bonds and gold. The fund’s unconstrained approach to asset allocation allows the fund manager to shift the portfolio quickly, and with conviction, between alternative economic scenarios.

The fund holds multiple asset classes. Up to 65%* of its net assets may be invested in international equity markets, with investment made directly into individual securities.

This fund is suitable for clients, who have a medium investment risk tolerance.

*This percentage is indicative only and the Investment Manager may, if necessary, alter or adjust it because of prevailing market conditions.

This fund is appropriate if your clients are seeking growth over the longer term seeking to make a positive environmental and social impact, while driving and benefitting from future growth.

To achieve this, the fund will invest in a portfolio of regulated collective investment schemes and fixed interest securities that have a clear and unambiguous focus on sustainability.

The Canaccord Genuity Global Equity Fund is an actively managed fund comprising of stocks and shares in great businesses from around the world.

Managed by Canaccord Genuity Asset Management, the Canaccord Genuity Global Equity Fund utilises our in-house fund management capabilities. The aim of the fund is to generate capital growth over the long term.

The fund adopts a bottom-up approach to stock picking, seeking high-quality businesses with a competitive edge. This can be a result of market leadership, technological advantage, or strong brand recognition, which often takes years to establish and is not easy to replicate. Typically, these companies are profitable and generate positive cash flows, which they can reinvest to drive future growth.

We prefer companies that are supported by long-term structural growth drivers, whether this is the accelerated adoption of technology, increasing global wealth or a shift to more sustainable materials.

The fund looks for opportunities across the market cap spectrum provided they have a minimum free float of at least US$1.0bn. The portfolio will not be concentrated in any specific region or industry sector. It is envisaged that the portfolio will be relatively diversified, generally comprising between 50 and 100 stocks.

We take a long-term view and in theory would like to hold stocks and shares in companies for as long as possible. However, we do not adopt a buy and hold forever approach. We believe it is important to maintain flexibility so we can take advantage of opportunities when they arise. Similarly, if a company is not delivering against our expectations, we will evaluate whether it is time to sell.

This fund is suitable if your clients have a high investment risk tolerance.

Investments in smaller companies, including AIM stocks, carry a higher degree of risk than investing in more liquid shares of larger companies, so they may be difficult to sell at the time you choose. Investments in smaller companies are more volatile and, while they can offer great potential, growth is not guaranteed.

Important announcement

The arrangements for marketing shares of Canaccord Genuity Bond Fund, Canaccord Genuity Balanced Fund, Canaccord Genuity Opportunity Fund, Canaccord Genuity Cautious Fund and Canaccord Genuity Growth Fund (the Funds) to shareholders in Italy and France are being terminated. Shareholders in Italy and France may redeem their shares, free of any charges or deductions. The procedure for effecting a redemption is set out in the Prospectus of Canaccord Genuity Investment Funds plc.

How to invest in our Specialist funds

You can access our funds on behalf of your clients by completing an application form from our fund literature page, through one of our CGWM relationship managers, or using a third-party life company.

Fund literature

Find all the information you need about our funds, including their prospectus, supplement, key investor information document, factsheet and application form.

Our people

How can we help?

If you'd like to know more about our Specialist funds or would like to know more about our services, speak to one of our team. We'll be delighted to give you more details.

Investment involves risk. The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

Our portfolios are designed to work over a typical investment cycle of seven to ten years, so we recommend you stay invested for at least seven years.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.