- Home

- News and insights

- Boost your pension by making use of unused pension allowance

Boost your pension by making use of unused pension allowance

Why is it important to check your unused pension allowance?

If you are a high-income earner, you could benefit considerably from personal pension tax relief. However, many people miss out if they have an unused pension allowance and/or do not take advantage of the pension carry forward rules. The subject of pension and tax is complicated, and we would always recommend you seek professional advice from a wealth planner and tax adviser to accurately calculate your unused pension allowance and to determine your pension carry forward position. If we can help, please click here and we will get in touch with you.

What is the annual pension allowance?

You can receive personal pension tax relief on the amount you contribute to your pension up to the annual pension allowance - this is the amount you can contribute to your pension tax free. For most people, this limit has been £40,000 since April 2014. However, if you are a high earner (i.e. total income above £240,000 in a year), a tapering rule applies meaning for every £2 of taxable income you receive over £240,000, your annual pension allowance is reduced by £1. The maximum reduction is £36,000. So, someone with an income of £312,000 or more may have an annual pension allowance of only £4,000 (in previous tax years the minimum annual allowance was £10,000).

Do you have an unused pension allowance?

A quirk in the pension and tax rules means that high earners could benefit from contributing more into their pension pots tax-efficiently using something called ‘pension carry forward’. The pension carry forward rules are complicated, although as the name suggests, you may be able to ‘carry forward’ your annual unused pension allowance going back to 2017/18 (or 2018/19 with effect from 6 April 2021) – when the allowable tax-free pension contribution per year was £40,000.

It's something many high-earners may not realise is available to them.

What is 'pension carry forward'?

The ‘pension carry forward’ rules mean you can use any unused annual pension allowances from the previous three tax years to contribute to your pension this tax year.

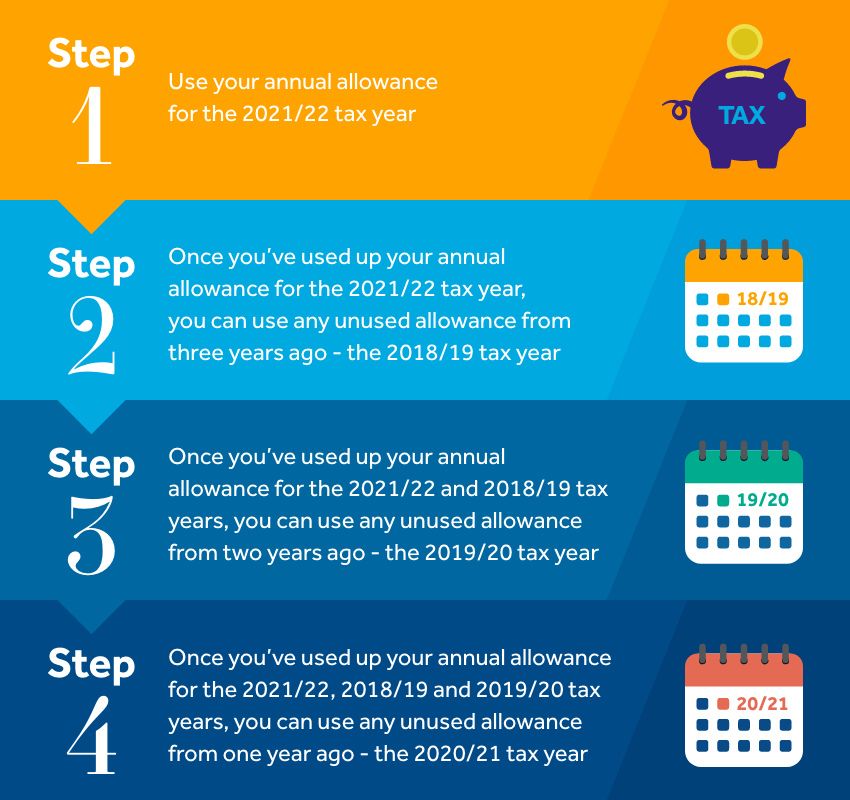

So, providing you have used up your annual allowance from say, the tax year 2021/22, you can go back and use your allowances from the previous three years, starting with the oldest one.

Step 1 - use your annual allowance for the 2021/22 tax year

Step 2 - once you've used up your annual allowance for the 2021/22 tax year, you can use any unused allowance from three years ago - the 2018/19 tax year

Step 3 - once you've used up your annual allowance for the 2021/22 and 2018/19 tax years, you can use any unused allowance from two years ago - the 2019/20 tax year

Step 4 - once you've used up your annual allowance for the 2021/22, 2018/19 and 2019/20 tax years, you can use any unused allowance from one year ago - the 2020/21 tax year.

How do the pension carry forward rules work in practice?

Susan runs her business consultancy via a limited company which she set up six years ago. She has been receiving a mixture of salary and dividends worth £312,000 per annum for the last five years, although she has not contributed to her pension during this time. She now has a healthy cash balance in the company and is interested in making a pension contribution.

As a high earner, Susan is subject to the tapering of her annual pension allowance from 2016 onwards - and her £40,000 annual pension allowance is reduced to:

- £4,000 for the current 2021/22 and 2020/21 tax years

- £10,000 for the 2019/20 and 2018/19 tax years.

However, the good news is Susan can benefit from the ‘pension carry forward’ rules and take advantage of her unused pension allowances in the previous three tax years as she has a personal pension which received contributions before she set up her company.

She has decided to take advantage of her unused pension allowances and contribute a £28,000 lump sum into her pension.

In Susan’s case, because she has her own business, her company can potentially make this pension contribution on her behalf. Susan’s accountant agrees that the company contribution is allowable under the ‘wholly and exclusive’ test - and the pension contribution is made from the cash reserves. It will be treated as an allowable business expense, so the company will receive tax relief against corporation tax and not have to pay national insurance on the contribution.

Pensions, unused pension allowances and the carry forward rules are complicated

We believe high income earners should seek professional advice on their unused pension allowances, with regular reviews, as it is a complex matter. In this article, we have deliberately simplified our explanations to show how an individual’s income levels can affect their pension allowances and contributions, but in reality the calculations will require significantly more work and explanation to ensure you do not have any unused pension allowances that could benefit from personal pension tax relief.

At Canaccord Genuity Wealth Management, we offer retirement advice via our independent wealth planners. To discuss how to make use of unused tax allowances to boost your pension, get in touch. We would be delighted to help answer your questions.

Let us contact you

If you're unsure which of our teams to contact, let us help you. We can put you in touch with one of our experts who will discuss your wealth management needs with you.

Found this interesting? Further reading:

- Top pension tips if you're about to retire

- Will I run out of money? How does cash flow modelling work?

- Why is it important for your pension and tax planning to check if you are putting too much into your lifetime pension?

- How can tax planning ensure you make best use of your pension annual allowance?

- Gifting money to family from excess income can be a useful part of your inheritance tax planning

- What to think about when reviewing your retirement plans

- Advice on inheritance tax planning

*Please note new limits since April 2020.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

The tax treatment of all investments depends upon individual circumstances and the levels and basis of taxation may change in the future. Investors should discuss their financial arrangements with their own tax adviser before investing.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.