- Home

- News and insights

- investing to beat inflation

Why aiming to beat inflation will be a key investment theme in 2022

The word ‘inflation’ had barely featured in the market’s vocabulary in the last three decades, until it suddenly came back with a vengeance in 2021.

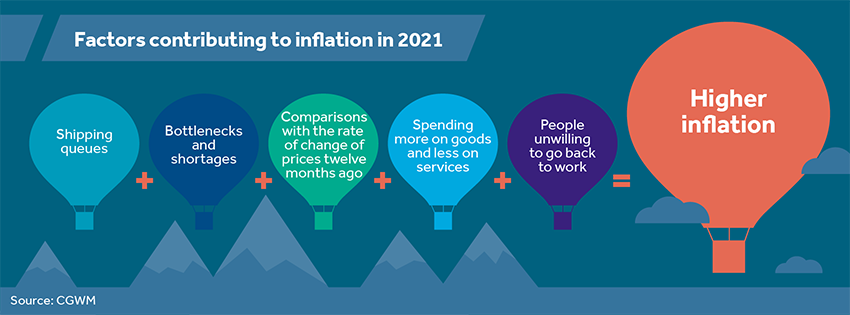

Investors were prepared for the ‘base effects’ (the impact of comparing current price levels in a given month against price levels in the same month a year ago) to drive up the CPI (consumer price index, the main measure of inflation) in March-May 2021. What was unexpected was the onslaught of bottlenecks and supply chain issues, as well as product and staff shortages, that relentlessly drove up prices.

As higher inflation looks set to persist in 2022, finding ways to generate a return on investments greater than inflation will be a key investment theme - otherwise your wealth falls in real terms. In this article, we look in greater depth at why we think investments that aim to beat inflation will be a major theme in 2022, and we introduce three key investment ideas which seek to beat inflation.

What has caused recent rises in inflation?

It started with economic reopening after the COVID-19 lockdowns. Goods, ships, lorries and drivers were not located in the right places when countries opened up, causing massive delays, product shortages and inevitably higher prices along the way.

In addition, many have been buying more products than before COVID-19, placing additional pressure on supplies. The cost of services we hadn’t used in a long time (such as air fares, car rentals, accommodation, restaurants) has also surged, some of it due to prices collapsing last year. You may also remember how in the spring of 2020, at some point crude oil prices were negative! No wonder price rises have been gigantic since.

Bottlenecks did not ease quickly and markets also began to worry about the possibility of soaring rents and wages.

Central banks kept saying that inflation was ‘transitory’, but this now seems to have been replaced by the word ‘persistent’. Inflation will remain high on the economic agenda in 2022.

Why will investors need to consider how to beat inflation?

Most analysts agree that inflation may not have reached its peak yet, so the situation for investors exposed to inflation may get worse before it gets better.

Some say the CPI could rise up to 15% in early 2023, but the one number that matters for markets is the US core personal consumption expenditures (PCE) index, which is the price gauge used by the US Federal Reserve (Fed) to shape its monetary policy. It soared to 6.8% in June 2022 and may still have some upside left.

What is the problem with saving and investing during times of higher inflation?

If you leave your money in the bank, you are highly unlikely to get deposit rates that will cover inflation. Likewise, if you buy fixed interest securities, where the coupon and the final repayment levels are fixed, you may not get your money back in real terms.

Commodities, however, generally manage to eke out a positive return after inflation, but it’s not always easy for an investor to buy petroleum and industrial metals profitably. Gold is a much easier purchase, and tends to provide returns that offset inflation in the long run.

Are equities the best investment option if your goal is to beat inflation?

History shows us that the best way to protect portfolios against inflation is through buying equities. This is because businesses that can pass on their increased costs, have the power to put prices up and can deal with complicated supply chains, may be able to provide good returns throughout inflationary periods.

There are nevertheless risks for investors. Higher inflation tends to reduce share valuations, which are ultimately a calculation of future earnings at today’s interest rate (if interest rates go up, share values historically go down).

Here at Canaccord, a key investment theme for 2022 is to protect discretionary portfolios against inflation, and we will try to achieve this by exploring three different equity-based options. You can read more about each investment idea by clicking through to the article mentioned below:

- Global equities may be a catch-all phrase, but the data shows us that well-selected global stocks can provide inflation protection.

- Automation and robotics can reduce the cost of repatriating manufacturing facilities to Western countries from China, but also offer opportunities for modernisation and increased efficiency in many sectors.

- Infrastructure builds fixed assets that reduce operating costs and hence offset higher prices, while infrastructure investments often have an explicit inflation protection built in.

Markets often fear inflation because central banks (especially the Fed) can destroy investment returns by raising rates to high levels and triggering an economic slump. The equity plays we mention should be able to cope with various inflation scenarios, as long as the Fed does not step on the brakes abruptly to cause a recession.

Watch our video to find out more:

Find this useful? Read more here:

- Can investing in global equities help beat inflation in 2022?

- Why investing in automation is a key investment theme in 2022

- Could investing in infrastructure safeguard against inflation in 2022?

- Why investing in the climate change agenda is a key investment theme in 2022

- Why investing in electric vehicles is a key investment theme in 2022

- Why investing in renewable energy is a key investment theme in 2022

- Why investing in a sustainable food system is a key investment theme in 2022

Speak to one of our experts

If you have any questions about the current environment or about your investments, please get in touch with us or email wealthmanager@canaccord.com.

Please remember, if you hold an account with Canaccord, you can check your portfolio value at any time, through Wealth Online or by getting in touch with your Investment Manager.

New to Canaccord Genuity Wealth Management?

If you are new to wealth management and would like to learn how this can benefit you, we can put you in touch with our team of experts that can help.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

This is not a recommendation to invest or disinvest in any of the companies, themes or sectors mentioned. They are included for illustrative purposes only.

The information contained herein is based on materials and sources deemed to be reliable; however, Canaccord Genuity Wealth Management makes no representation or warranty, either express or implied, to the accuracy, completeness or reliability of this information. Canaccord is not liable for the content and accuracy of the opinions and information provided by external contributors. All stated opinions and estimates in this article are subject to change without notice and Canaccord Genuity Wealth Management is under no obligation to update the information.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.