Advice on inheritance tax planning

The issue of inheritance tax (IHT) planning will always be controversial. This is largely because it’s a secondary tax on accumulated wealth that has already been subject to tax, or even an inheritance that has already been subject to IHT. As such, we are often asked to give advice on inheritance tax and how to set up a wealth management plan to legitimately manage IHT – and inheritance tax planning has become a core part of our wealth planning service.

IHT is also part of a complex landscape where the rules surrounding the tax are daunting and change regularly. Because it’s such a controversial topic, it often attracts political attention with threats to the simple and legitimate ways of IHT planning, such as we cover in our inheritance tax planning tips. And even though our independent financial advisers are always on hand to give advice on inheritance tax, it is a tax that most people put off addressing, mainly because it doesn’t impact your finances within your lifetime.

In this article, we provide some advice on inheritance tax planning generally as well as some inheritance tax planning tips which might allow you to manage your IHT more effectively. Our independent financial advisers are here to provide more specific advice on inheritance tax for your personal situation; please click here if you would like a free consultation.

Our key piece of advice on inheritance tax planning: it should be a considered and very precise process

You have worked hard to build and protect your wealth and you want to make sure it continues to be preserved as far as possible, even when you die. However, your wealth might one day be liable for IHT and, without the right arrangements in place, this could affect how much you can leave behind.

This is why it is essential to know how IHT will affect you, your relatives and any other beneficiaries, and how to make sure they do not pay more than they need.

IHT planning should be a considered and very precise process and cannot be rushed, so it is important not to plan in isolation. IHT planning should be part of an overall strategy that encompasses your lifetime financial goals and assets, even though constituent parts may be executed separately and at different times.

Another important piece of advice on inheritance tax is to make sure you stay informed about the inheritance tax planning rules and do things in the right order, as this could also impact the amount of inheritance tax your beneficiaries will need to pay.

Our top inheritance tax planning tips

The following solutions can offer simple and legitimate ways of inheritance tax planning:

1. Deed of variations

This instrument allows beneficiaries of a deceased’s estate to alter the distribution of that estate by altering the deceased’s will. The effect of this is that the original beneficiary can redirect the legacy or entitlement to a third party, without it being counted as a gift from the original recipient. An example might be an older beneficiary varying the will in favour of grandchildren if he or she is not in need of money. The advantage is it will not form part of the intended recipient’s estate and be taxed again when they eventually die.

Of course, it is preferable to set up your will and estate to consider the IHT implications before you die to make sure your wishes can be respected as far as possible, which is where advice on inheritance tax planning can really help.

2. Outright lifetime gifts

Inheritance tax planning can be as simple as making use of a series of gift allowances, which will escape IHT if you survive seven years from the date of the gift:

- Spouses or civil partners can gift any value to each other during their lifetime, as long as they are both domiciled in the UK.

- You can make gifts to other people, of up to £3,000 in total in each tax year. This is known as the ‘annual exemption’. You can carry forward a maximum of one year, so you could gift up to £6,000 in a particular tax year.

- You can make any number of gifts of up to £250 each year to separate individuals. These gifts are meant to cover things like birthday and Christmas presents. You cannot combine these with the annual exemption described in the paragraph above.

- You can make gifts to UK-established charities, national museums, universities, the National Trust and certain other bodies.

- You can make gifts to people getting married, up to: £5,000 from each parent of the couple, £2,500 from each grandparent or remote relative, £2,500 from bridegroom to bride (and vice versa) and between civil partners, or £1,000 from anyone else.

3. The main residence allowance or transferable residence nil-rate band

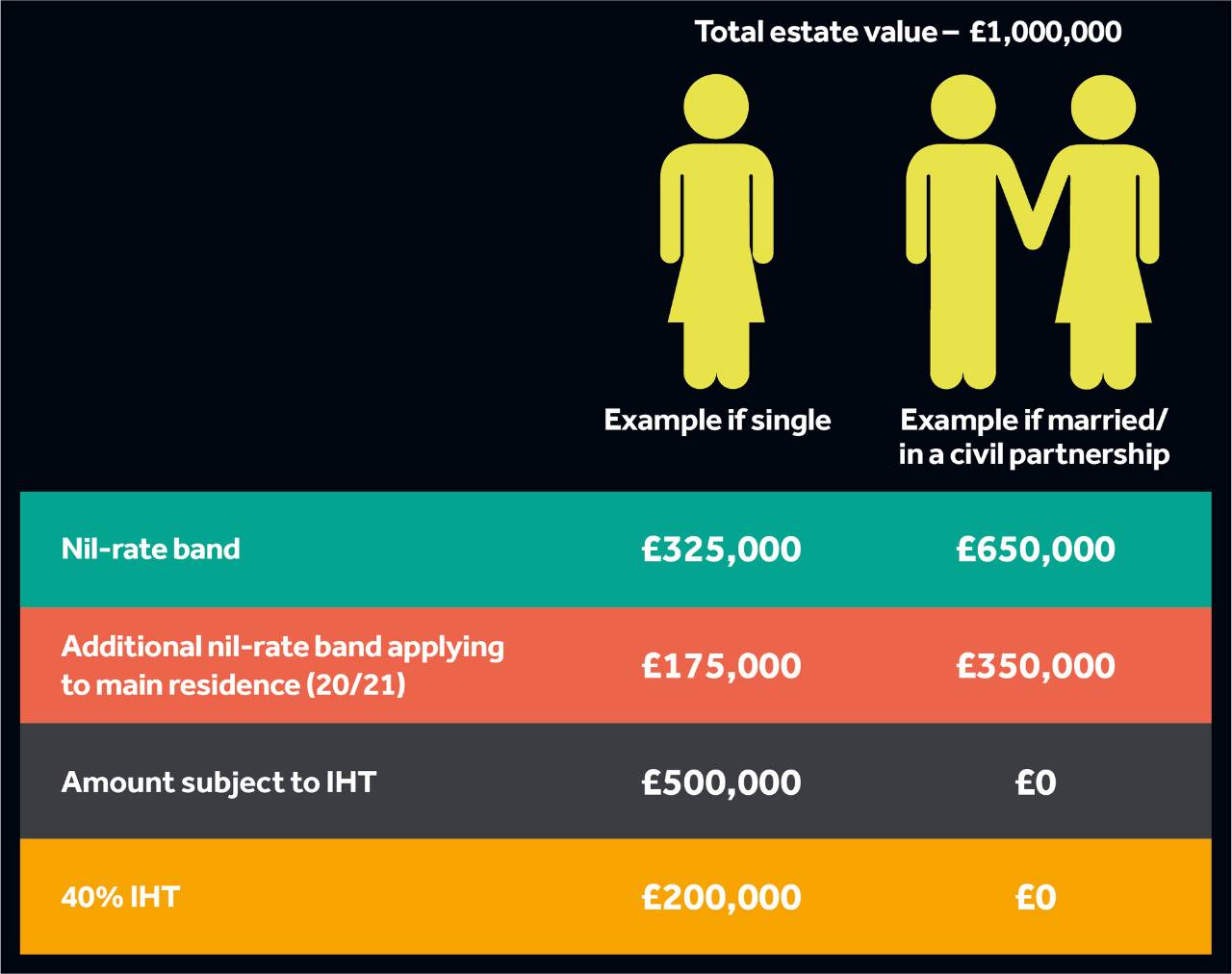

IHT is charged at a rate of 40% and is payable on anything of value that’s left behind when you die over and above the nil-rate band of £325,000. To understand the basics of calculating your inheritance tax, you might find our IHT calculator useful.

The biggest change to affect the inheritance tax landscape is the ‘main residence allowance’ or ‘inheritance tax threshold’ which adds £175,000 to the inheritance tax nil-rate band.

George Osborne introduced the transferable residence nil-rate band in order to mitigate the effect of rising house prices on IHT in the 2015 summer budget. This is an additional allowance to the ordinary nil-rate band and applies when a parent leaves their main residence to their children or grandchildren when they die.

The individual allowance increased to £175,000 in April 2020. As with the usual IHT allowance, it’s also transferrable to a surviving spouse or civil partner. For example, if one partner dies, their IHT allowance could be £325,000 plus £175,000 for their main residence i.e. £500,000. On the death of the second partner, the couple’s combined allowance could potentially reach up to £1m of allowances before IHT becomes payable, although only £350,000 can be set against the main residence. This new allowance is reduced for estates worth more than £2m.

The residence nil rate band can only be offset against your primary residence, so your primary residence must be worth the equivalent of your available residence nil-rate band in order to make use of the full exemption. Alternatively, if you have downsized your home since April 6 2015 and your current property is worth less than your available residence nil rate band, you can utilise the equivalent of the sale value of your former property.

Watch this video, in which our Head of Wealth Planning explains some inheritance planning top tips:

Final piece of advice on inheritance tax planning

There are many ways in which you can legitimately manage the IHT due on your estate – but make sure that any arrangements don’t leave you struggling to maintain your own lifestyle.

If you want to make use of any of the ideas suggested in this article, please feel free to contact us and one of our independent financial planners will be pleased to have a chat with you.

IHT planning advice

Arrange a free consultation with an independent wealth planner.

Found this useful and want to read more:

- Managing inheritance tax – gifting excess income

- Managing inheritance tax with AIM Shares

- Are you doing enough to manage your inheritance tax liability?

- Your guide to inheritance tax - calculate your potential IHT bill in five minutes

Your capital is at risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

The tax treatment of all investments depends upon individual circumstances and the levels and basis of taxation may change in the future. Investors should discuss their financial arrangements with their own tax adviser before investing.

The current inheritance tax rules and tax treatment of AIM shares may change in the future. We strongly recommend that clients discuss their financial arrangements with their tax adviser before investing, as the value of any tax reliefs available is subject to individual circumstances

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.