- Home

- Investment management

- Smaller companies

Small-cap investing

Make the most of our small-cap investment expertise

Smaller companies (referred to as small-caps) can offer attractive investment opportunities and could potentially form part of any investor’s diversified portfolio. However, picking small-cap stocks can be risky, so the devil is in the detail.

Small-cap investing is often ignored by investment and wealth management firms, who may lack the expertise to evaluate the potential of these companies and invest on your behalf.

At Canaccord Genuity Wealth Management we have both a breadth and depth of small-cap investing expertise, including a dedicated small-cap investment committee and specialist investment analysts. In fact, we are among the most experienced independent UK wealth managers in this area, with a long history and heritage.

Our small-cap investment experts are constantly monitoring smaller companies that are becoming pioneers in their area, are at the forefront of innovation, are playing a vital role in the growth of an emerging sector or are simply doing something better or faster than before.

Interested in investing in small-caps?

Book a free consultation with a small-caps investment specialist.

Investments in smaller companies, including AIM stocks, carry a higher degree of risk than investing in more liquid shares of larger companies, so they may be difficult to sell at the time you choose. Investments in smaller companies are more volatile and, while they can offer great potential, growth is not guaranteed.

Our small-cap investment services

We believe investing in small-caps can be an important part of a truly diversified and well-balanced portfolio because they can deliver superior returns and growth, but they are a more volatile investment and come with a higher risk, which is why having a specialist in small-cap investing working in your interests can make all the difference.

You can take advantage of our in-house small-caps investment expertise through our small-cap equity-only portfolio service or as part of a diversified investment portfolio. Both options are available as either a discretionary account or on an advised stockbroking basis, if you prefer to make your own trading decisions.

Small-Cap Portfolio Service (equity-only)

Our standalone Small-Cap Portfolio Service is an equity-only and very high-risk portfolio. This is only suited to certain types of investors who are willing and able to take higher risk and more volatility in exchange for potentially higher growth. Some clients use this service to carve out a small-cap investment portfolio as part of their overall wealth.

If you would like to explore this service, please get in touch so our specialist small-cap investment managers can work with you to determine if it might be suitable for you.

Download ‘Our investment risk framework’ for more information on how we classify different types of investment portfolio. This type of small-cap portfolio would be classified as a Risk 8 or 9, our highest risk profiles.

Discretionary portfolio management

More usually, exposure to small-caps can be included as part of a diversified portfolio if we think it is appropriate for your personal situation, alongside large-caps and other asset classes.

Interested in investing in smaller companies?

If you are interested in small-cap investing, but would like more information, we can help.

Investments in smaller companies, including AIM stocks, carry a higher degree of risk than investing in more liquid shares of larger companies, so they may be difficult to sell at the time you choose. Investments in smaller companies are more volatile and, while they can offer great potential, growth is not guaranteed.

Our small-cap investment strategy

How we choose small-cap companies to invest in

When choosing smaller companies to invest in, our specialist small-cap investment committee carries out extensive research and analysis. They then create a shortlist of companies that meet our criteria. We look for businesses with:

- high-quality management

- history of consistent earnings

- dividend growth

- balance sheet strength

- proven cash generation

- high barriers to entry

- reasonable valuation

- strong earnings growth

- owner managers.

How we seek out small-cap opportunities

Building on these criteria, we look for opportunities in businesses within these categories:

- Niche businesses: companies that satisfy a specific market need

- Roll-out stories: companies that are expanding, either in phases or store-by-store

- Market leaders: companies that enjoy the largest market share in their peer group

- IPOs: companies raising initial capital to help them transform from a private company to a public listed entity

- Industry consolidators: companies that are buying up their competitors and improving them

- Special situations: companies where our dynamic and nimble approach can exploit short-term market opportunities or identify early stage management change and corporate turnaround

Small-cap investing – your questions answered

Small-cap, short for small market capitalisation, stocks are surrounded by myths and misunderstandings – and we want to help de-bunk some of those issues by answering the questions we’re most often asked. You can also download our free ‘Guide to small-cap investing’ for more information.

Small-cap investing is literally buying shares in smaller companies, with the objective of seeing them grow and generating a return on your investment. It is often called ‘growth investing’, as the value of the company will – hopefully – grow for the duration that you invest in it. So, if, for example, you buy shares for £5 a share and the company doubles its market capitalisation, you might be able to sell your shares for £10 a share.

Whether or not this happens is subject to many different variables – and investors need to be mindful that the company they invest in could lose value as easily as it could increase in value. Investments in smaller companies are high-risk and they tend to be more volatile and illiquid. Selling may be difficult, and they can fall further than the wider market. They are more exposed to fluctuations in the domestic economy and growth is not guaranteed. Therefore, they are not suitable for all investors.

Smaller companies are not micro businesses like your local coffee shop or boutique. Smaller companies can be well-established market leaders and household names, expanding businesses or those carving out a niche in certain markets. Smaller companies’ market capitalisations are relatively small i.e. the value of the company that is traded on the stock market calculated by multiplying the total number of issued shares by the present share price. A rough rule of thumb is market capitalisations (market worth) of between £100m and £2bn– which doesn’t sound small until you compare it to an Apple ($2.44trn as at 28 September 2022) or a Microsoft ($1.76trn market cap as at 28 September 2022).

So, by smaller companies, we mean those that are:

- Listed on AIM - these companies can have a market capitalisation above £2bn.

OR

- Have a market capitalisation of less than £2bn and not within the FTSE 100 – this includes companies within the FTSE 250, FTSE Small cap and FTSE Fledgling Indices.

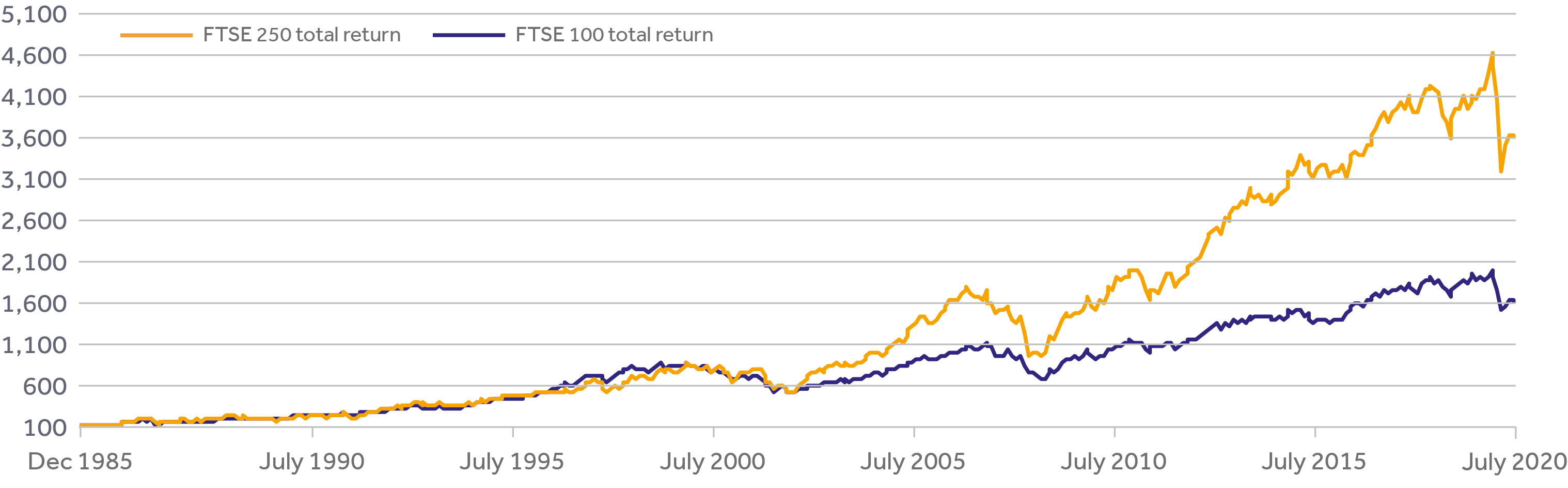

Small-cap investments can deliver superior returns and growth. Historically small-cap stocks have outperformed large-cap stocks, but they are a more volatile investment and come with a higher risk. That’s why it’s important to have a small-cap investment specialist by your side.

Data as at end July 2020. Source: FTSE and Bloomberg.

The benefits of small-cap investing include:

Growth:

Relative to larger organisations, small-caps can grow much more rapidly, which is more likely to be reflected in the value of your investment. It can take a long time for a large organisation to double in size – but, if they grow, growing by 25%, 50% or even 100% is much more common among smaller companies.

Initial Public Offerings (IPOs):

If a small company is privately owned but is then listed on a stock exchange (such as AIM) this is an opportunity for investors to increase the value of their holding, although this isn’t always the case as some companies devalue after their IPO.

Mergers & Acquisitions:

Smaller companies are a more accessible size, so there tend to be more takeovers within the small-cap community. Compared to larger companies, smaller companies are more likely to buy their competitors or be sold to competitors, which could potentially create an opportunity for investors to increase the value of their holding.

Strong positions in niche markets:

Niche smaller companies satisfy a very specific market need. This can either be a smaller, mature market that is more isolated from disruption – niche markets are usually small enough that large-caps wouldn’t justify the cost of entry – or they are rapidly growing small markets that haven’t attracted the attention of a bigger operator in a related field. An example could be the gaming sector in the UK – a big growth sector within small-cap investing.

Ability to roll out business plans:

These are smaller companies that have a proven and successful offering and are in the process of rolling out their product to new markets either in phases or store by store.

More tech in UK small-caps:

There is a significant quantity of tech stocks in the small-cap sector and a real dearth of tech stocks in UK large cap despite tech being the real growth story of recent years (look at the Facebooks, Amazons, Netflixes etc.).

Whether it is better to invest in small-caps or large-caps will depend on your personal situation and your risk appetite. It is all about achieving the balance that is right for you.

Small-caps are often related to growth investing, although this is not always the case. Investors want to make money from the trajectory of the company’s growth; if a company’s value increases, so does the value of their shares.

Large-caps on the other hand are often related to income investing or ‘quality investing’, although this is not always the case. Investors will make money from the companies they invest in paying out shareholder dividends.

Small-cap investing is usually riskier because:

- The general perception is that larger organisations are by their nature safer – they are much less likely to go bust than smaller companies.

- Smaller companies tend to have a more volatile trajectory – their growth can be far more rapid than their larger counterparts, but similarly, their decline can be just as rapid.

- Smaller companies are also much less liquid than larger companies. They have access to less cash as they tend to invest their capital in future growth, so investors might not be able to liquidate their investment (i.e. get their cash out) as easily as they might in larger companies.

- Smaller companies also tend to fly under the radar a bit more (they don’t attract as much analyst coverage as larger firms) so investors need to do a bit more groundwork to understand what they are investing in. It is also a reason why investing in a fund that focuses on the small-cap universe is usually a safer option than investing directly in small caps – the fund manager is more likely to be a small-cap expert than you.

How much you invest in small-caps depends on your situation and should be proportionate to your risk appetite, i.e. the level of risk you can afford to take.

If you are a pensioner or approaching retirement, you are more likely to have a lower level of risk and more likely to be an income investor (investors who make money from dividend payouts from the companies they invest in).

If you are younger and are likely to be investing in the markets for a long time to come, or if you have a large amount of investable capital then you probably have a higher level of risk tolerance and are more likely to be a growth investor (buying shares at a certain value and trying to sell them for more).

If you were happy with a higher level of risk, you could potentially allocate more of your investments to small-caps. Ultimately, however, it will depend on your personal situation, so speak to one of our wealth managers before deciding what is right for you.

When economies emerge from recession or a period of slow growth and start to grow again, this can be a good time to consider investing in smaller companies as it tends to be a time for fairly rapid growth. This means growth investors may see returns on their original investments more quickly than they might at other times of the economic lifecycle.

Market corrections provide good opportunities for investors. If markets experience a period of volatility and drop off in value, this often equates to a good buying opportunity for investors because when markets rise again, so do the value of their investments.

How can our small-cap investment experts help you?

Our experts have been finding and analysing smaller companies for many years and understand what they are looking for. As they are well-known in the small-cap investment arena, they are often invited to meet the company’s management directly and are regularly presented with interesting new investment opportunities which they will analyse on your behalf.

They are also supported by the size and scale of Canaccord Genuity which means we have a substantial annual investment market research budget (running into the hundreds of thousands) and long-term relationships with all the key small-cap brokers, giving our small-cap investment strategy a strong competitive advantage.

- Adam Caplan, Investment Director

- Adam Newman, Investment Manager

- Alex Van Moppes, Investment Director

- Andrew Findlater, Investment Director

- Dan Marks, Investment Director

- Ian Berry, UK Small Cap Equity Analyst

- Laurence Leigh, Investment Manager

- Leon Shuall, Investment Director

- Michel Perera, Chief Investment Officer

- Paul Parker, Head of Intermediary Investments

- Richard Champion, Deputy Chief Investment Officer, UK

- Russell Wynn, Investment Director - Stockbroking

- Simon McGarry, Senior Equity Analyst

Keeping you informed

After decades of zero and even minus interest rates why have Japan finally succumbed to increasing rates? Our experts in Edinburgh investigate.

Read moreRead our latest Investment Outlook to learn how we are navigating through the economic turbulence to identify key investment opportunities.

Read moreSome of our small-cap experts

If you would like to know more about our small-cap offering please get in touch. We will be delighted to provide more details of our services.

How can we help?

If you would like to know how we can help with your investment management, wealth or financial planning needs, get in touch. We will be delighted to provide more details of our services.

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.