Encouraging Progress

March 11, 2024

By Tom Collinson, Director, Managed Accounts and Tony Brennan, Chief Investment Strategist

The pandemic era has been full of surprises and last year was no different in the way conditions unfolded in financial markets. It began with widespread expectations that inflation, whilst beginning to slow, was unlikely to moderate sufficiently whilst economies and corporate earnings remained resilient. This was the conventional wisdom, based on experience, and a sharp rise in interest rates was expected, in time, to have a marked influence on economic growth.

Added to this was a deeply inverted yield curve in the US which had preceded recessions over the last 60 years. Typically, longer term bonds provide investors with higher yields than bonds closer to maturity, but since mid-2022 this premium had been negative, with higher yields in shorter dated bonds, an indication that interest rates were considered above their long-term norm.

Yet, whilst the interest rate increases across developed economies certainly have had some effect, factors unique to this cycle have resulted in better economic growth and financial market performance than was forecast by many investors and economists last year. And, the path of disinflation, as it has become known, of bringing inflation back to central bank targets, has so far been smoother than many anticipated.

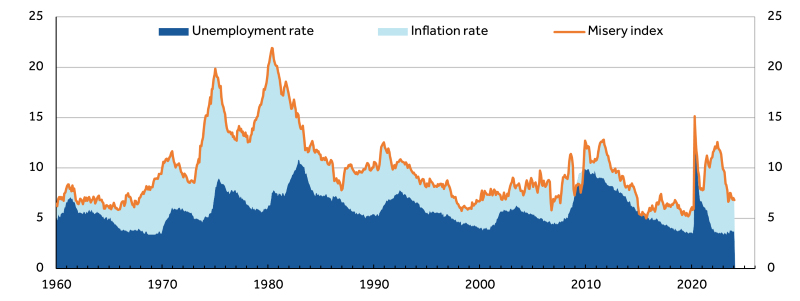

A measure that reflects this performance is the so-called “Misery Index”, which adds together the rates of unemployment and inflation in an economy, as an indicator of the difficulty of conditions being faced. The Misery Index, which rose sharply in recent years in many economies, as can be seen for the US in Figure 1, first as unemployment jumped in the pandemic, and then as inflation surged, has since dropped back, much sooner than might have been expected. In the past, when inflation emerged, it only tended to come down with higher unemployment, as in the 1970s and 1980s, prolonging the Index’s high readings.

Figure 1: US, misery index (unemployment rate plus inflation rate), %

Source: Federal Reserve Bank of St Louis, Canaccord Genuity

Supply and Demand

What has been different in this episode? On the inflation side, it was certainly the case that there was a challenge. Year-on-year CPI inflation in the US rose to 9% and was still running at over 6% at the beginning of last year, whilst in Australia it was still around 8%. Both figures were far above the targets of the Federal Reserve and the RBA and interest rate increases continued, with the last Fed hike in August and the RBA most recently increasing the cash rate in November.

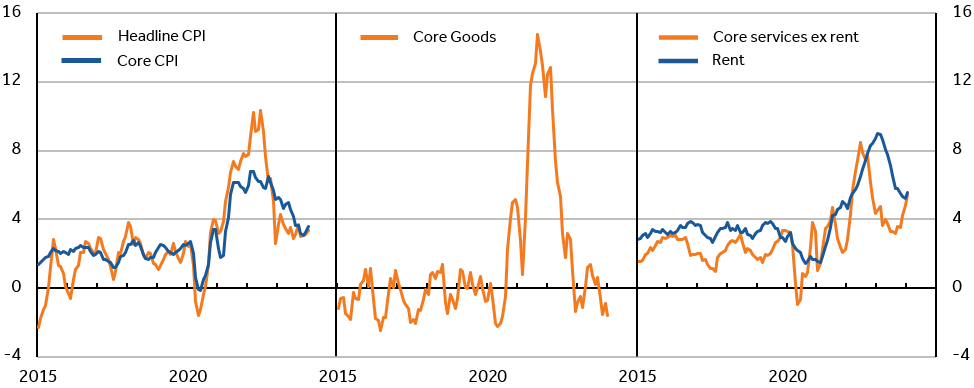

CPI inflation had been driven up in 2021 and 2022, as supply chains that had been constrained by pandemic restrictions, and demand from consumers less able to spend their money on services, combined to cause rapid goods price inflation. Then the subsequent reopening of economies allowed consumers to pivot away from buying goods and towards spending again on services, like travel and restaurant dining, which they hadn’t been able to do.

By the middle of last year this had actually led to a measure of goods price deflation, whilst services inflation was still high. But with the catch up in services spending now looking to have worked its way through economies more, services inflation in most of the developed world has been beginning to recede too, and these trends in the components can be seen for the US in Figure 2. This has made the path towards the inflation targets of central banks clearer and fueled the strong rally in equity markets since November, bringing most of last year’s gains. Though victory has not yet been declared over inflation and there could still be setbacks, which we discuss below.

Figure 2: US, consumer price inflation (6 month change at annual rate), %

Source: BLS, Refinitiv, Canaccord Genuity

Economic Resilience

With the benefit of hindsight, many forecasters, anticipating recessionary conditions to accompany the moderation in inflation, given the rapid rise in interest rates, underestimated the impact of not just the normalization of supply and demand, but also the counteracting and pro-growth forces operating in economies. This included the built-up pandemic-era personal savings, the aggressive rehiring of employees laid off during the pandemic, and ongoing fiscal stimulus in the form of public sector budget deficits. These factors appear to have been particularly important in the US, but have also mattered in Australia, albeit with more restrained fiscal spending and waning commodities prices allowing the economy to slow more.

The excess savings in the US were assisted by the forced saving of lockdowns, as well as the direct payments from several rounds of stimulus cheques that continued even after inflation had begun rising and economic growth was strong again. And by some measures, those savings had yet to be fully depleted even at the end of last year. Alongside this, the US Government budget deficit remained at over 6% of GDP last year, a scale of deficit unprecedented outside of recessions or wartime, as the US Government has sought to accelerate the transition to clean energy sources and onshoring of manufacturing supply chains.

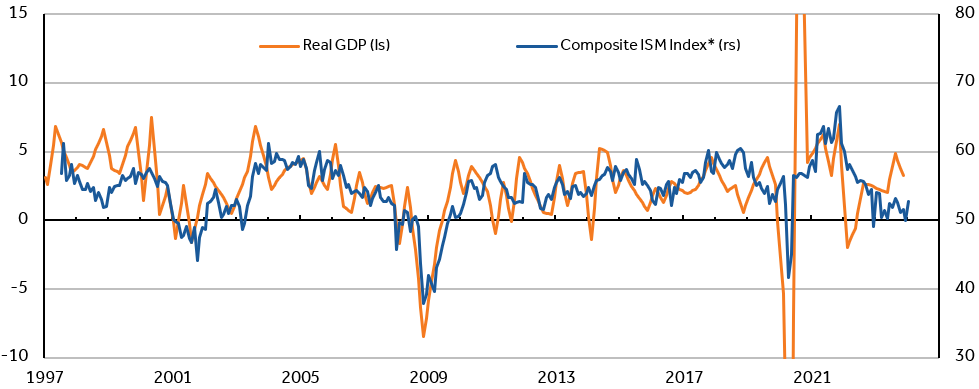

Consequently, growth in US GDP was unexpectedly sustained above trend last year, even strengthening from mid-year, as shown in Figure 3, and underpinning company earnings and the end of year rally in the equity market. This was the ultimate surprise, with growth accelerating while inflation was falling, with the added support of the Federal Reserve signaling that interest rates were expected to be lowered over the coming year.

Figure 3: US, real GDP (quarterly % growth at annual rate) and ISM Index

Source: US BEA, Refinitiv, Canaccord Genuity

* Weighted average of manufacturing and non-manufacturing ISM indexes

The upshot of this unexpectedly favourable progress should be a brighter investment outlook than appeared the case this time last year, when high inflation, now substantially reduced, overshadowed markets. There are, of course, still risks – that inflation remains “sticky” above targets and that growth eventually slows more sharply. But, being closer to their goals, central banks should be better placed to respond, and any risks should be more manageable.

That said, the potentially optimistic inflation, growth and interest rate scenario priced into markets during the strong equity market rally of recent months may lead to volatility if challenged. And in the articles that follow, we note the risk of some retracement again in markets, given that conditions might not unfold as ideally as seems presumed, and we outline our investment strategies in this environment.