Lifting Weighting in Equities

March 12, 2024

By Tony Brennan, Chief Investment Strategist

The progress in reducing inflation nearer to central bank targets while sustaining reasonable economic growth, both overseas and in Australia, would seem to have diminished the risk of a hard landing for economies and a severe correction in equities again. Conscious of this, we have lifted our recommended weightings in equities back to neutral, alongside a recommended overweight position in fixed income, and facilitated by an underweight position in cash. Of course, there are still risks, but these should now be more manageable for central banks, and a near-term correction in equities could provide grounds for eventually moving overweight.

Progress Domestically

Markets have been buoyed over the past few months by the improved inflation outcomes in the US and elsewhere and the scope they have provided for prospective monetary policy easing, without the weakness feared in economic growth. In Australia, with economic developments still a little behind those abroad after our slightly later emergence from the pandemic, progress has been less dramatic, but has still been meaningful and with the economy seemingly on a similar path.

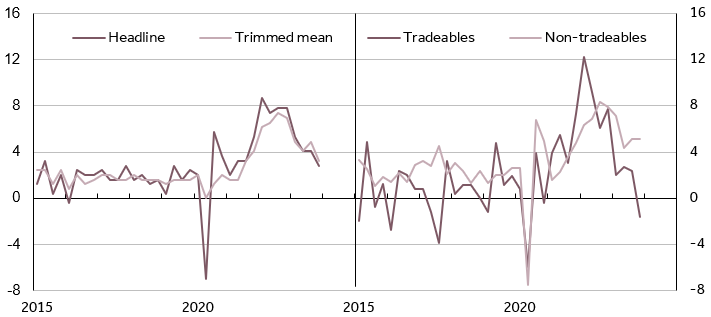

Most importantly, recent inflation readings have been back closer to the RBA’s target, running at an annualised rate of under 4% (Figure 1). This is encouraging, and though it will need to persist and ease further, the restrictive monetary policy in place may be sufficient to ensure that. There are still grounds for caution, with moderation in global inflation accounting for a significant part of the progress, while domestic inflation pressures have eased less, evident in the dichotomy between inflation for internationally traded and non-traded items. But this is similar to the remaining challenges abroad and should just require more time.

Figure 1: Australia, CPI inflation, quarterly % change at annualised rate

Source: ABS, Canaccord Genuity

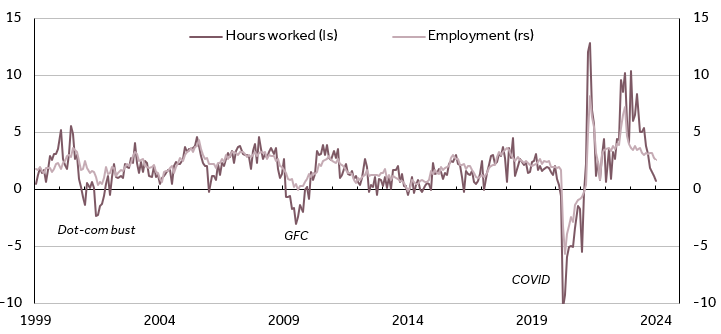

Like elsewhere, wage growth has picked up to above rates in the years before the pandemic, and to be sustainable needs productivity growth to improve. But wage growth may also slow now, lessening the risk of persistent inflation, as the labour market cools and unemployment rises. To date, employment growth has stayed quite resilient, but hours worked have slowed sharply, indicative of how businesses may be responding to weaker demand (employing part-time rather than full-time workers, reducing overtime), and this should be a precursor to more unambiguously slower employment growth (Figure 2).

Figure 2: Australia, employment and hours worked, 12 month ended % change

Source: ABS, Canaccord Genuity

As well as containing wage growth, a clearer rise in unemployment could slow the economy further, along with the constraining effects of more fixed rate mortgages moving on to higher variable rates again this year, and the excess savings available from the pandemic diminishing. With GDP growth likely already having slowed to an annual rate of only around 1% in the second half of last year, the RBA could well have now done enough to ensure sufficient continued downward pressure on inflation, and it seems possible that it could even be in a position to cut interest rates later this year.

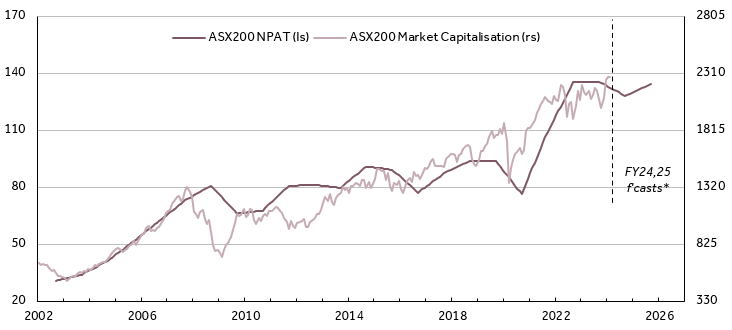

This suggests a potentially more promising backdrop for the Australian equity market, even after the rally over the last few months, which has still only left market valuation broadly in line with company earnings, and not obviously elevated (Figure 3). The challenge is more corporate earnings growth itself, which is currently expected to be modest over the next two years – as a decline in resource earnings following lower commodity prices over the past 18 months is projected to offset a return of earnings growth in the rest of the market.

Figure 3: ASX200 Index, NPAT and market capitalisation, $billion

Source: IBES, S&P, Refinitiv, Canaccord Genuity estimates

*Forecasts are derived from consensus estimates

However, if inflation does subside and interest rates are lowered, while economic growth remains positive, both globally and in Australia, there is the potential for a stronger earnings outlook to drive upgrades to earnings forecasts, which has historically not been uncommon in such conditions, and this could provide the underpinning for a continuing rise in the Australian market.

Nearly There Internationally

Overseas, the progress in reducing inflation has proceeded further, in the US and Europe in particular, and in the US has occurred, quite unexpectedly, with economic growth remaining above trend. Yet, notwithstanding the solid growth, with the progress on inflation the Federal Reserve still anticipates easing its restrictive monetary policy later this year, and the market has factored in the Fed moving even harder and faster in lowering interest rates, and left the question of how much of the potential upside for markets has already been priced in, and particularly if the exceptional progress is not sustained.

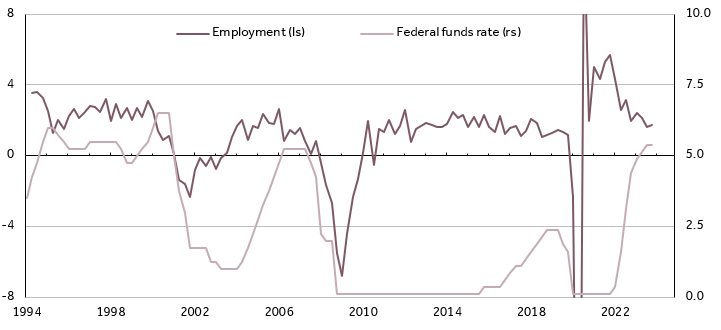

The most genuine risk seems to be that of inflation remaining volatile and staying above the Fed’s target for longer than expected, leaving less scope to cut interest rates until later. This might occur if US growth remains strong, as it has to date, evident in both GDP growth in the latter half of last year, and employment growth over recent months (Figure 4). However, with US monetary policy continuing to be in restrictive territory, more slowing in US growth would seem likely this year, and that should maintain downward pressure on inflation and lessen the risk of inflation persisting above the Fed’s target for too long.

Figure 4: US, employment (quarterly growth at annual rate) and interest rates, %

Source: US BLS, Fed, Refinitiv, Canaccord Genuity

In fact, it’s envisaged that some further softening in US labour market conditions is still likely, with a modest rise in US unemployment projected, and the Fed seems unlikely to want that to go too far before easing policy, similar to how it has responded to such weakening conditions in the past. The labour market and wages growth have a significant influence on services inflation, which has rebounded since mid-year and could keep inflation sticky, but US wages growth has already moderated considerably, and seems on course to slow further and act to ease services inflation over time.

So, it would still seem in prospect that the Fed will cut interest rates this year as it has projected, particularly given the possibility that US employment growth could drop below trend and unemployment rise more than desired. That could mean some short-term weakness in the US economy and corporate earnings, but the equity market may look through that if interest rates are coming down, and any weakness could provide a buying opportunity. The US market already appears back at a full valuation, but earnings forecast upgrades are also common when interest rates are lowered and economic growth is not unduly weak.

Accordingly, with the progress in reducing inflation while reasonable growth has continued, and the reduced risk now of a major economic contraction, particularly in the US but also in Australia, in our tactical asset allocation advice we have lifted our recommended weighting in equities back to neutral, while maintaining a recommended overweight position in fixed income, facilitated by an underweight position now in cash.