A well-structured financial plan is the cornerstone of long-term success.

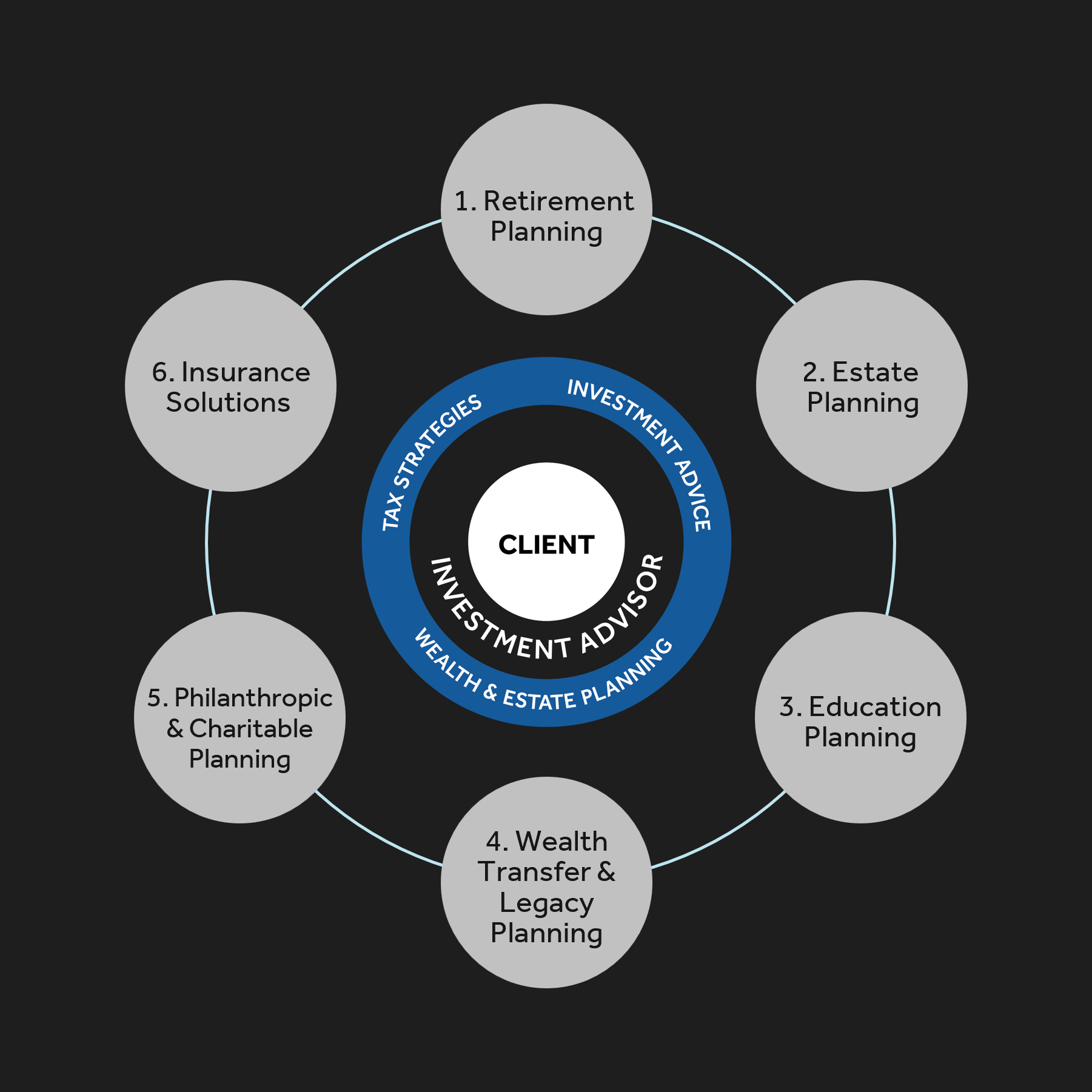

We provide a full suite of wealth management services designed to protect and enhance your financial well-being. Our approach includes investment management, personalized financial, estate, and insurance planning, strategic tax solutions, philanthropic guidance, and tailored education funding strategies— ensuring every aspect of your wealth is thoughtfully managed and optimized.

Retirement Planning

Optimized Use of Retirement Vehicles:

Ensure Canada's retirement income vehicles are strategically integrated into your overall wealth plan to maximize efficiency.

Regulatory Navigation and Tax Efficiency:

Maximize your retirement savings with guidance on contribution limits, withdrawal conditions, and tax implications.

Designing a Sustainable Income Stream:

Develop strategies that ensure a steady and reliable income throughout your retirement, balancing growth and security.

Estate Planning

Proactive Planning to Streamline Administration:

Planning can reduce costs and administrative headaches. It can also mitigate risks associated with family disputes, legal challenges, or unforeseen tax obligations, securing a smooth transition of assets.

Personalized Solutions for Lasting Impact:

All families and businesses are unique, and so are their estate planning needs. Benefit from personalized advice, integrating legal, financial, and tax considerations to help maximize your legacy.

Education Planning

Customized Savings Plans:

Examine the rising demands of education with savings strategies that address tuition and ancillary costs—accommodation, technology, transportation, and more—that students face.

Wealth Transfer & Legacy Planning

Family Education on Financial Stewardship:

Prepare for the responsibilities of significant wealth, including business assets, by fostering a deep understanding of financial stewardship. Through personalized education plans, empower the next generation to manage and grow their inheritance in alignment with your family’s values and objectives.

Philanthropic & Charitable Giving

Seamless Integration with Investment Strategies:

Philanthropy is more than just a charitable act; it’s a powerful tool that can seamlessly align your long-term wealth goals with significant tax benefits and create a lasting legacy and social impact. It can be the once-in-a-lifetime opportunity to implement meaningful and sustainable legacies that will greater impact than impulsive or haphazard giving.

Insurance Solutions

Protecting What Matters Most:

Secure your family’s future and ensure long-term financial security with tailored life insurance solutions designed to protect what matters most. As an Accredited Insurance Provider, we approach insurance with a unique perspective— focused on delivering better client outcomes, not just selling products. From business succession planning to charitable giving, we ensure that your coverage aligns with your broader financial objectives.

A Holistic Financial Planning Process

A well-structured financial plan is the cornerstone of long-term financial success. We begin by understanding your current and future financial situation, ensuring your plan meets your needs.

-

01

Client Discovery

Through an immersive discovery process, we delve into understanding your core values, strategic priorities, and long-term goals. These discussions form the essential foundation for building your tailored financial strategy, integrating your unique circumstances into our reimagined wealth management approach.

-

02

Plan Development

We develop a bespoke financial plan that harmoniously integrates investment optimization, tax-efficient structuring, legacy planning, philanthropic initiatives, and multi-generational wealth preservation strategies.

-

03

Review and Finalization

Once created, we will review your plan together. Based on this discussion, our team fine-tunes the strategy, incorporating any adjustments needed to reflect changes in your circumstances.

-

04

Implementation

Your wealth strategy is implemented and monitored on a continuous basis to optimize your portfolio for sustained and long-term success.

-

05

Ongoing Review and Support

Life evolves, and so should your financial plan. Our continuous engagement, proactive insights, and regular reviews ensure your portfolio remains aligned with your ever-changing needs.