- Home

- Investment solutions

- Investment funds

- Multi-asset fund of funds

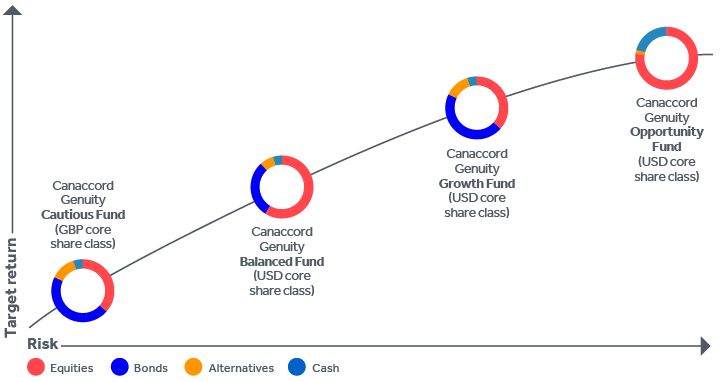

The diagram below shows the different levels of risk and return for each of our Canaccord Genuity multi-manager funds.

The funds may invest in equities, bonds, alternative investments such as commodities and cash, with the allocation to each asset dependent on the risk profile of the fund and the views of our expert asset allocation team. We prioritise liquidity to ensure that the composition of the funds can be adjusted quickly should the need arise.

This fund is designed to generate an income and capital growth. It manages risk to preserve capital value and achieve a consistent total return.

The fund holds multiple asset classes, including collective investment schemes, direct bonds and other yielding assets. Up to 50% of its net asset value may be invested in international equity markets.

As well as its core sterling share class, the Canaccord Genuity Cautious Fund is available in euro, Swiss franc, Australian, Canadian, Singapore and US dollar hedged share classes.

This fund is appropriate if your clients are seeking growth over the longer term.

To achieve this, the fund holds multiple asset classes. Up to 60%* of its net assets may be invested in international equity markets through the securities of regulated collective investment schemes.

As well as its core US dollar share class, the Canaccord Genuity Balanced Fund is also available in euro, sterling, Swiss franc, Australian, Canadian and Singapore dollar hedged share classes.

* This percentage is indicative only and the Investment Manager may, if necessary, alter or adjust it because of prevailing market conditions.

This fund is appropriate if your clients are seeking growth over the longer term.

The portfolio invests to achieve the best return while considering the risk of each investment and holds multiple asset classes to achieve this. Up to 85%* of its net assets may be invested in international equity markets through the securities of regulated collective investment schemes.

As well as its core US dollar share class, the Canaccord Genuity Growth Fund is also available in euro, sterling, Swiss franc, Australian, Canadian and Singapore dollar hedged share classes.

* This percentage is indicative only and the Investment Manager may, if necessary, alter or adjust it because of prevailing market conditions.

We have been running the strategy for this dynamic fund with great success since 2001. It is appropriate if your clients are seeking growth.

It can hold multiple asset classes but focuses on achieving growth with less concern about volatility, so up to 100%* of its net assets may be invested in international equity markets through the securities of regulated collective investment schemes.

As well as its core US dollar share class, the Canaccord Genuity Opportunity Fund is also available in euro, sterling, Swiss franc, Australian, Canadian and Singapore dollar hedged share classes.

* This percentage is indicative only and the Investment Manager may, if necessary, alter or adjust it because of prevailing market conditions.

Important announcement

The arrangements for marketing shares of Canaccord Genuity Bond Fund, Canaccord Genuity Balanced Fund, Canaccord Genuity Opportunity Fund, Canaccord Genuity Cautious Fund and Canaccord Genuity Growth Fund (the Funds) to shareholders in Italy and France are being terminated. Shareholders in Italy and France may redeem their shares, free of any charges or deductions. The procedure for effecting a redemption is set out in the Prospectus of Canaccord Genuity Investment Funds plc.

What are the benefits of a multi-asset, fund of funds?

Also known as a ‘multi-manager fund', the Canaccord Genuity fund of funds are made up of other investment funds (which are themselves made up of different assets) rather than investing directly in stocks, bonds or other kinds of securities.

They allow your clients to access a greater range of investment expertise and opportunities, as well as the specialist fund selection and ongoing reviews provided by a discretionary investment management service – but at a lower cost.

How to invest in our Canaccord Genuity multi-asset funds

To access the Canaccord Genuity multi-manager funds the minimum investment is GBP 5,000 (or currency equivalent).

Fund literature

Find all the information you need about our funds, including their prospectus, supplement, key investor information document, factsheet and application form.

Investment involves risk. The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

Our portfolios are designed to work over a typical investment cycle of seven to ten years, so we recommend you stay invested for at least seven years.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

How can we help?

If you'd like to know more about our Canaccord Genuity fund of funds or would like to know more about our services, speak to one of our team. We'll be delighted to give you more details.

Download our brochure

- Find out the details of the service

- Read about how we'll keep you informed

- Find out more about our wider services

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.