Calculating inheritance tax with our simple IHT calculator

An inheritance tax calculation is essential to know what IHT is payable on your estate after death. However, it is a good idea to use our simple IHT calculator to create your own inheritance tax calculation now so that you have some idea of your potential IHT liability. In turn, this can help you decide if you should start some inheritance tax planning in order to manage any potential IHT liability.

If you would rather speak to one of our independent financial advisers to discuss your personal situation and work with them to calculate your potential IHT, please contact us for a free consultation.

Calculate your potential IHT bill in five minutes

To help you, we have created a simple-to-use IHT calculator. Once you have filled in the steps, you will be able to get an indication of your potential inheritance tax bill.

The rest of this article provides more details on current IHT rates and a couple of simple examples of inheritance tax calculations.

What are the current IHT rates?

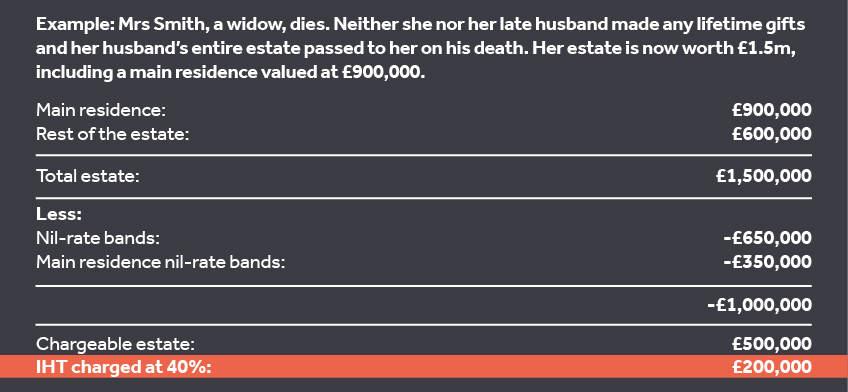

IHT is currently charged at a rate of 40% on assets passed to beneficiaries (other than a spouse or civil partner) over and above the ‘nil rate band’ of £325,000.

A new separate allowance, ‘the main residence allowance’ was introduced in 2017 which applies when someone leaves their main residence to their children or grandchildren. This allowance is currently £175,000 meaning an individual’s allowances could reach up to £500,000 before their heirs have to pay IHT. This new allowance is reduced for estates worth more than £2m and subject to certain conditions.

The examples of inheritance tax calculations below are based on these rates.

How do I include the residence nil-rate band in my inheritance tax calculation?

A combination of the ‘standard’ and ‘residence’ nil-rate bands could allow up to £500,000 of your estate to be exempt from IHT and up to £1m for a couple from April 2020. The residence nil-rate band is gradually reduced for estates worth in excess of £2m and completely exhausted for joint estates currently worth more than £2.7m.

Inheritance tax planning to manage your potential IHT bill

Having completed your own inheritance tax calculation, you may wish to undertake some IHT planning in order to manage how much your beneficiaries might have to pay, especially if your estate is sizeable or complex.

There is some useful information in our other articles, below, or you can contact one of our IHT wealth advisers for a free consultation.

Speak to one of our investment experts

To discuss your investment needs, book a complimentary, no-obligation consultation.

Read more here:

The tax treatment of all investments depends upon individual circumstances and the levels and basis of taxation may change in the future. Investors should discuss their financial arrangements with their own tax adviser before investing.

The tax treatments set out in this communication are based on our current understanding of UK legislation. It is a broad summary and cannot cover every circumstance and it does not constitute advice.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.