Why investing in the climate change agenda is a key investment theme in 2022

It is the increasing momentum to finding solutions to the climate crisis that makes climate transition such a lasting and powerful investment theme in 2022 and beyond.

We are not climate scientists, nor policy makers, and we make no specific predictions here about the future path of global warming. All we are seeking to do is identify where value is being created for our clients.

With the pressures of regulation and the tailwind of technological advance, increasingly we are seeing investment opportunities in climate transition where new, increasingly investable industries are disrupting old economy stalwarts.

How is political pressure influencing action on climate change?

Much sound and fury surrounded the recent UN climate conference in Glasgow. COP26 (the 26th ‘Conference of the Parties’) was meant to check in on progress towards the climate change targets set in previous conferences, in particular COP21 (which led to the 2015 Paris Climate Accord), and take the necessary steps to keep us on the trajectory set out in that treaty.

Signed by 180 countries (and which the US famously exited under President Trump before re-entering under President Biden), Paris sought to reduce greenhouse gas emissions and limit the global temperature increase to below 2℃ above pre-industrial levels by the year 2100. Ideally, the agreement aimed to keep the increases to below 1.5℃.

And a progress report was much needed. Before the commitments made in Glasgow, base case estimates had global temperatures rising to 2.8℃ above pre-industrial levels, despite of all the work done over the preceding six years. Even after all the pledges at Glasgow, on a good outcome we might be looking at 2℃ as the base case - which is not a good outcome.

Which industries are causing damage to our climate through greenhouse gas emissions?

The vast majority of damage to our climate stability has taken place over the last 50 years. That this happened should be no surprise. 50 years ago the population of the world was around 3.7 billion souls. Today it is around 7.9 billion, an increase of 114%. At the same time average real GDP per head has increased significantly.

So we have seen a population explosion and have made ourselves much richer too – and that means making more stuff, which means burning more coal, more oil and creating more methane. In 1970 global crude oil production was around 40m barrels per day. Now, without COVID-19, it would be around 100m barrels per day.

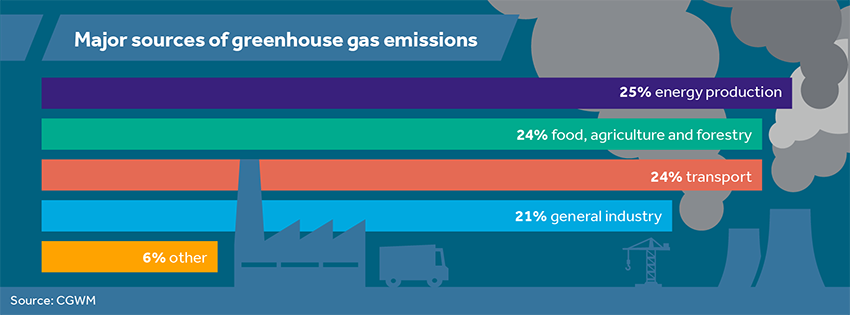

Today, of the five or six major sources of greenhouse gases, energy production contributes 25%, food, agriculture and forestry 24%, transport 24% and general industry 21%. Each of these areas is under huge pressure to reduce their outputs.

How can reducing greenhouse gases be a sensible investment theme?

Under the broad investment theme of climate transition, we look specifically at the three main contributors to greenhouse gases, where a combination of rapid improvements in technology, cost-effectiveness compared with traditional companies and increased regulation has created what we consider to be a compelling long-term investment case.

Investing in clean and renewable energy

Sharp falls in the cost of generating wind, solar and other renewable energies (not to mention nuclear), allied with judicious use of government subsidy, has transformed the competitiveness of green alternatives to carbon-based power. This is a trend reinforced by burgeoning concerns over air quality in fast-growing and huge emerging markets like India, China and Nigeria.

Investing in the sustainable food revolution

Food is an area often overlooked for its impact on greenhouse gas emissions, although most people recognise that the combination of cow burps and other ‘emissions’ alongside deforestation linked to intensive soybean cultivation, is a powerful additive to the greenhouse effect.

With more efficient plant biotechnology and enormous progress in the cost-effectiveness of meat substitutes, there is a real prospect of making inroads into this large contributor to global warming.

Investing in the electric vehicles’ ecosystem

In transport, advances in battery technology, software and power management semiconductors now mean that it is not just automobiles that are decarbonising, but also trucks, railways, marine transport and even airplanes.

Why is climate transition a key investment theme in 2022?

Combined, these three areas comprise nearly two thirds of greenhouse gas emissions. In each case, what makes them particularly timely as investment themes is the rapid development of technology that enables substitution of traditional, carbon-heavy industries with far more climate-friendly equivalents, creating businesses that are now in the early stages of generating potentially strong cash flows for their shareholders.

We can already see why it is so important to get on the right side of this investment theme. Many large institutional investors are specifically excluding carbon-intensive industries like coal mining or oil producers from their investment universe and increasingly the banking system is withdrawing from financing their activities. This means that in addition to the headwinds from climate treaties and other regulation, the cost of doing business for such companies is set to rise.

We see this as a positive approach to investing in an area all-too-often associated with negative statements along the lines of “thou shalt not”. In the longer term we are confident this will align good client outcomes with a sustainable future for our planet, our children and their children.

Watch our video to find out more:

Find this useful? Read more here:

Speak to one of our experts

If you have any questions about the current environment or about your investments, please get in touch with us or email wealthmanager@canaccord.com.

Please remember, if you hold an account with Canaccord, you can check your portfolio value at any time, through Wealth Online or by getting in touch with your Investment Manager.

New to Canaccord Genuity Wealth Management?

If you are new to wealth management and would like to learn how this can benefit you, we can put you in touch with our team of experts that can help.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

This is not a recommendation to invest or disinvest in any of the companies, themes or sectors mentioned. They are included for illustrative purposes only.

The information contained herein is based on materials and sources deemed to be reliable; however, Canaccord Genuity Wealth Management makes no representation or warranty, either express or implied, to the accuracy, completeness or reliability of this information. Canaccord is not liable for the content and accuracy of the opinions and information provided by external contributors. All stated opinions and estimates in this article are subject to change without notice and Canaccord Genuity Wealth Management is under no obligation to update the information.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.