Opportunities in investment trusts

The last two years have seen a series of world events that have taken turns to dominate news headlines – the Russia-Ukraine war, China’s increasing presence in the South China Seas, the ongoing conflict in Gaza and most recently the attacks by Houthi rebels on shipping in the Red Sea. These events have all had economic repercussions – in particular, fuelling inflation due to the increased prices of agricultural products, oil, shipping costs and more.

However, from an investment perspective, the most important repercussion has been the movement in interest rates and their likely future direction. After 14 years of zero interest rates, it was easy to predict that the next move would be up. That said, what caught the market by surprise was how quickly central banks acted. For example, the Bank of England raised rates in 14 consecutive meetings from December 2021, when rates were 0.1%, to 5.25% in August 2023. In the USA, the numbers were 11 consecutive rises to July 2023. In this article, we look at the impact that this changing tide has had on investment trusts – and the potential opportunities arising for investors investing in investment trusts.

What are investment trusts?

Investment trusts are a type of collective investment fund. They are 'closed-end' funds that are publicly traded on a stock exchange. Unlike mutual funds, investment trusts have a fixed number of shares and are traded on the open market like stocks, which means their prices can differ from the value of their underlying assets.

The ripple effect of rising interest rates

This led to a change in investor behaviours. In the time of low interest rates, investors were using many of the trusts investing in infrastructure, property and other alternative assets as proxies for fixed income, at a time when the latter was generating relatively low rates of returns. Therefore, when higher rates meant that fixed income became an attractive investment, many of these trusts were sold, for the first time in 14 years. This had two key knock-on effects:

- Share price adjustments: shares of these investment trusts, which had previously traded at a premium due to high demand, transitioned to a discount

- Net Asset Value (NAV) pressure: for some assets, particularly property and growth shares, NAV came under significant pressure as trusts were sold.

This had a ‘double whammy’ effect on investment trusts. Firstly, investor perception deteriorated, in part driven by concerns about the liquidity and stability of the investment trusts, driving share prices further down and creating big discounts to underlying value (NAV)*. Secondly, many of the affected trusts had low liquidity, which meant that these price falls were exacerbated as investors sought to sell.

Bouncing back: the opportunity of rate cuts

Looking forward, the key question for investors is when interest rates will be cut, as this will result in an improved outlook for these investments – and therefore create opportunity for investors. At the end of October, economic data led the market to a consensus view that the first cut would be in March or April 2024. This triggered a sharp bounce in rate-sensitive trusts. However, more recent data, especially around jobs vacancies, hourly earnings and consumption, has meant that central bankers have become less dovish. Nobody is expecting rate rises in the near future, but it is inevitable that cuts will have to happen at some point.

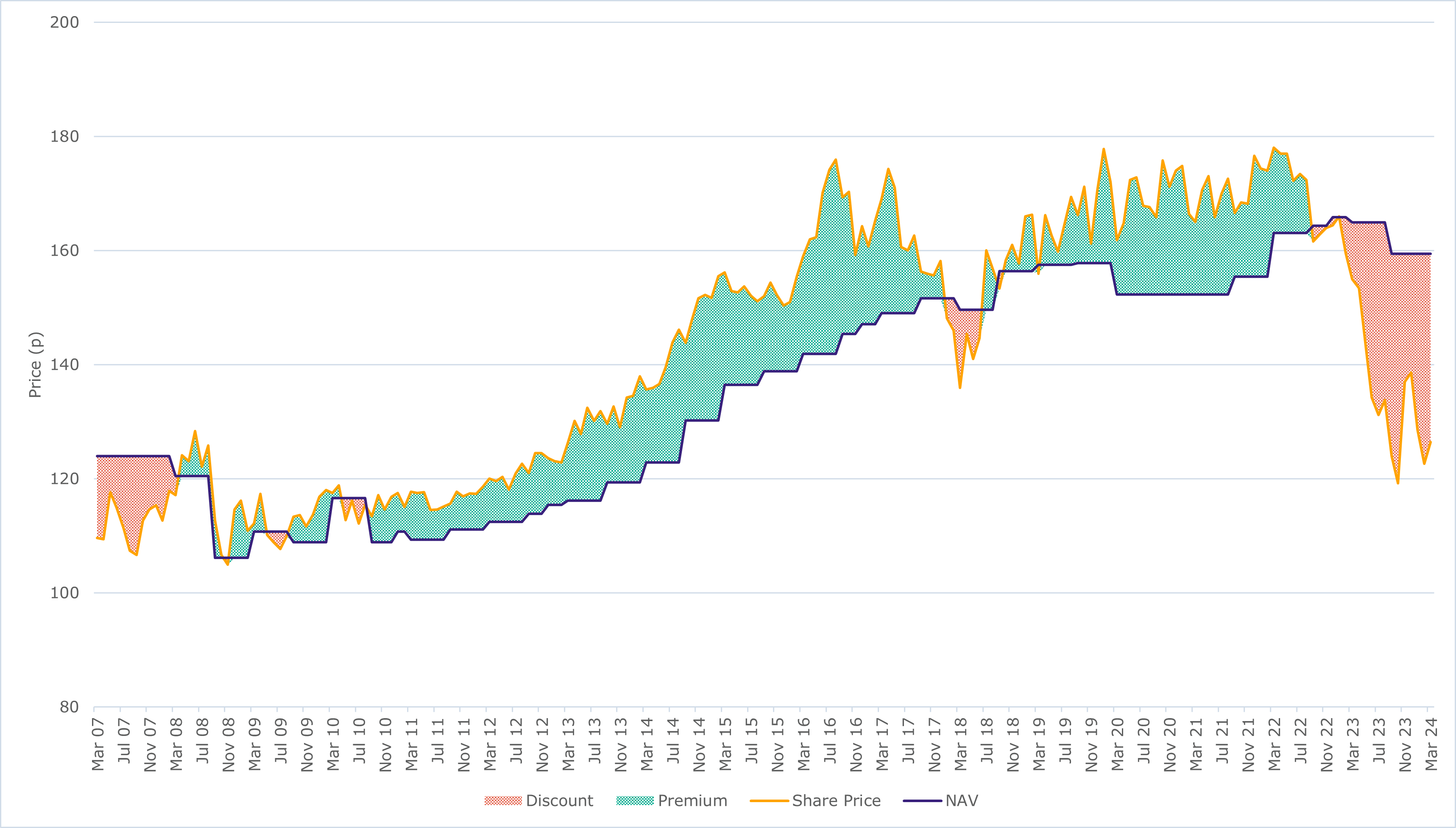

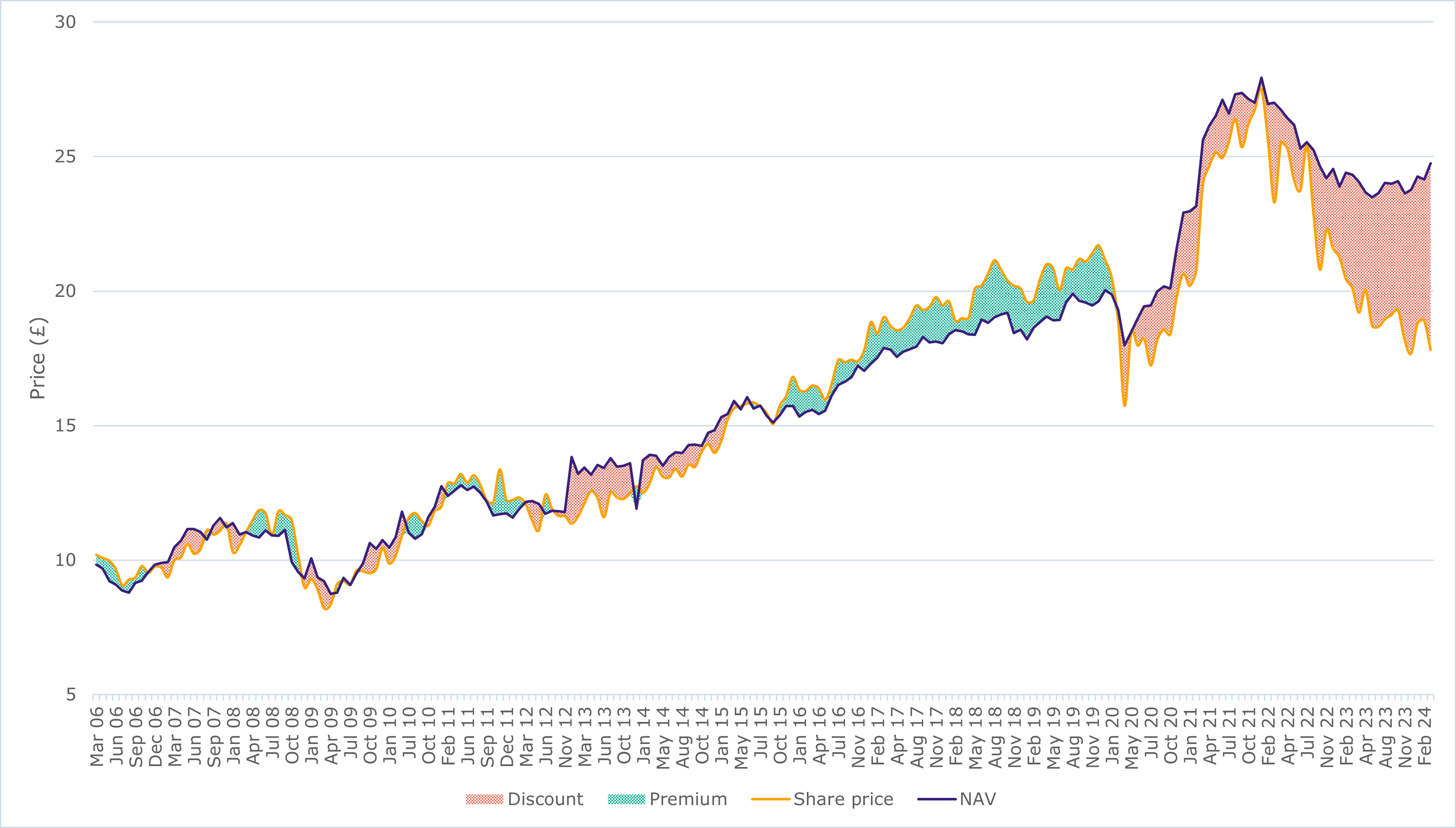

Consequently, the recovery in rate-sensitive investments has stalled. But it also means that there is still considerable upside to be found. Some of the discounts are as high as at the depth of the Great Financial Crisis (2008) and the COVID-19 Pandemic (2020). In addition, as can be seen in the two example charts below, rates are at similar levels as those in 2008 but the discounts to NAV are very different:

HICL Infrastructure PLC

RIT Capital Partners PLC

Source: Bloomberg. The sections shaded in red indicates the current extent of the discounts, despite interest rates being similar to those in 2008.

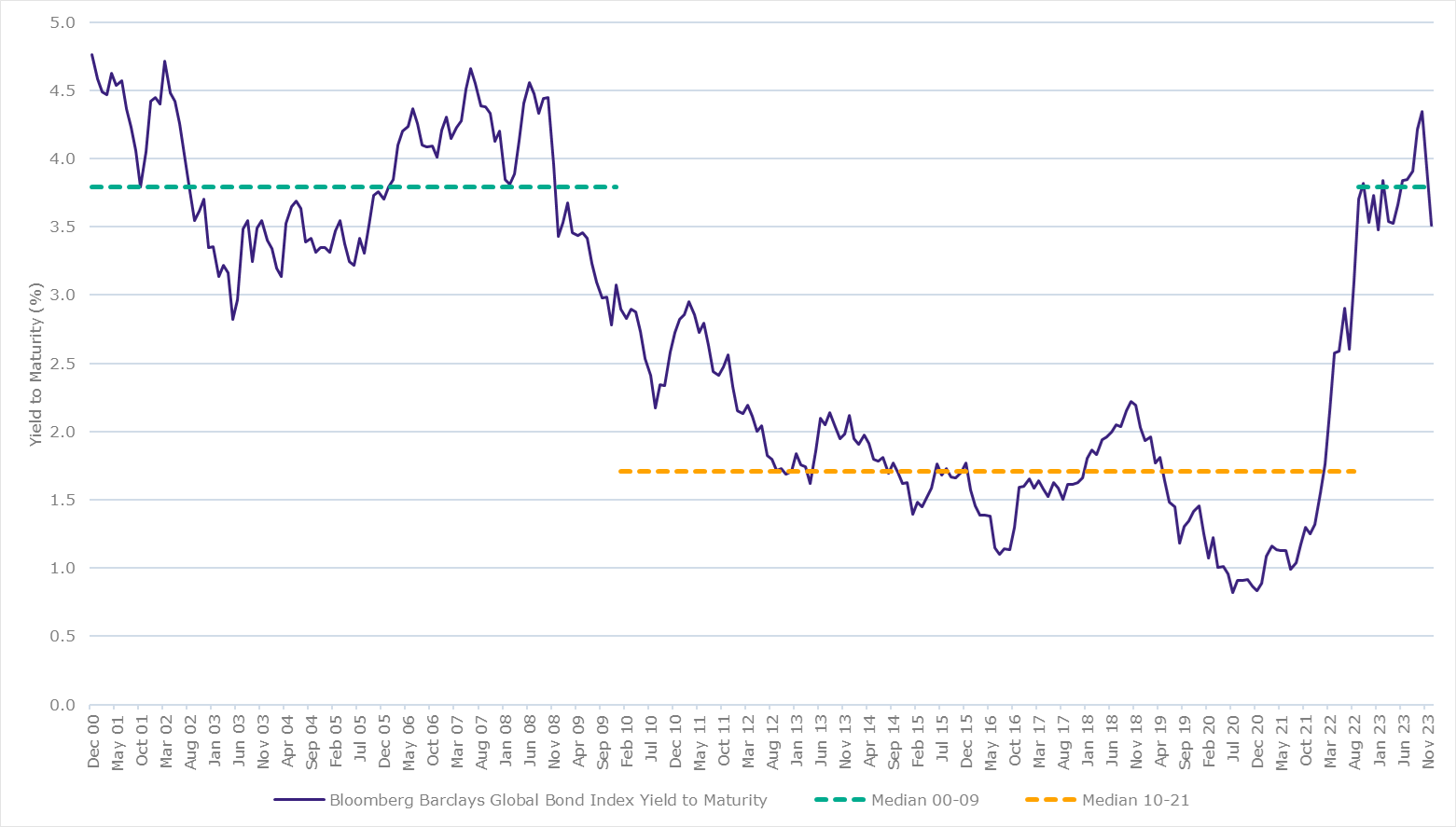

In the 14 years prior to 2022, bond yields were artificially depressed by central banks through quantitative easing programmes in their attempt to stimulate a turgid economy in the face of the aftermath of the global financial crisis. Since 2022, central banks have moved to normalise interest rates – which means we are back to the position where we stood before 2007/2008.

Source: Bloomberg.

Since the next move in rates is likely to be down, the comparative value of many of these investment trusts compared to bonds will reappear, and we expect the discounts to the NAV will narrow. In addition, in sectors such as property, where NAVs have been downgraded, lower interest rates will result in the NAVs on these trusts being upgraded again.

As a result, we believe that this presents an opportunity for investors. In our view, a combination of declining discounts, reductions in interest costs, and underlying NAV growth should mean that share prices in many of these investment trusts should improve markedly.

Get in touch

If you have any questions about how your portfolio might benefit from this, or about investment management more generally, please speak to your dedicated Investment Manager who will be happy to talk you through it.

In case you missed it:

- Spring webinar: Can current economic 'deceleration' actually accelerate investment portfolios?

- Japan – is it finally hitting the right notes?

- Our investment outlook for 2024

- Why healthcare and infrastructure sectors are still key portfolio components

Speak to our team

If you are new to CGWM, find out how our investment experts can help you build a diversified portfolio.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

This is not a recommendation to invest or disinvest in any of the companies, themes or sectors mentioned. They are included for illustrative purposes only.

The information contained herein is based on materials and sources deemed to be reliable; however, Canaccord Genuity Wealth Management makes no representation or warranty, either express or implied, to the accuracy, completeness or reliability of this information. Canaccord is not liable for the content and accuracy of the opinions and information provided by external contributors. All stated opinions and estimates in this article are subject to change without notice and Canaccord Genuity Wealth Management is under no obligation to update the information.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.