Balancing the risk and rewards of investing

When we choose investments for our model portfolios or for individual discretionary clients, we constantly weigh up the potential rewards compared with the amount of investment risk involved. We assess the general and specific risks of each investment and balance that against how much we believe it is worth.

Investment timing is crucial

If we think generally, there are times when risks are high, but valuations are low – 2008, for example, when the right approach was to ‘hold one’s nose’ and take a lot of investment risk. On the other hand, there are times when valuations are expensive, complacency is rife, and the best advice is to wait for better opportunities ahead.

Of course, hindsight is a wonderful investment tool, but the end of 2021 was an example of such a situation. The extreme actions of central banks and the ‘free money’ of zero interest rates led to asset valuations that were poor compensation for the risks that arose in 2022 and 2023.

There are other times when the balance between risk and reward are ‘about right’, including the volatile situation we find ourselves in today. The geopolitical framework is fracturing, inflationary pressures remain, and central banks are acting tough on interest rates.

Do asset valuations reflect the pressures on markets?

How much of this is already reflected in the current market price of the investments we are considering? An all-out conflict in the Middle East, a rapid resurgence in inflation and interest rates persistently above 6% are not suitably reflected in today’s mix of asset valuations and may not have been factored into the market prices of the investments under consideration. Fortunately, all these outcomes happening at once is not the most likely scenario.

Today, investors have a problematic equation to balance; you only need to turn on the news to see that the world is a difficult place, but this is now better reflected in asset valuations. Jamie Dimon, the Chairman and CEO of JPMorgan Chase, the world’s biggest bank, believes that “Now may be the most dangerous time the world has seen in decades.” However, he has recently unveiled another record set of earnings for the bank, suggesting that it has managed to navigate these difficulties successfully.

This gives us confidence that, after a couple of challenging years, investment portfolios can again resume their path to achieving clients’ long-term aims and aspirations. This confidence is increased when we start to think about individual regions and specific assets that we can include in our investment strategies.

Investing in fixed interest bonds

Let’s start with fixed interest (investing in bonds), which has been a mostly boring asset class over the last decade, when interest rates were at zero and central banks had manipulated many bond markets to the point of being ‘uninvestible’. We view a painful 2022 as a necessary and overdue ‘clearing event’ for fixed interest markets, which has created a much better backdrop for making healthy returns.

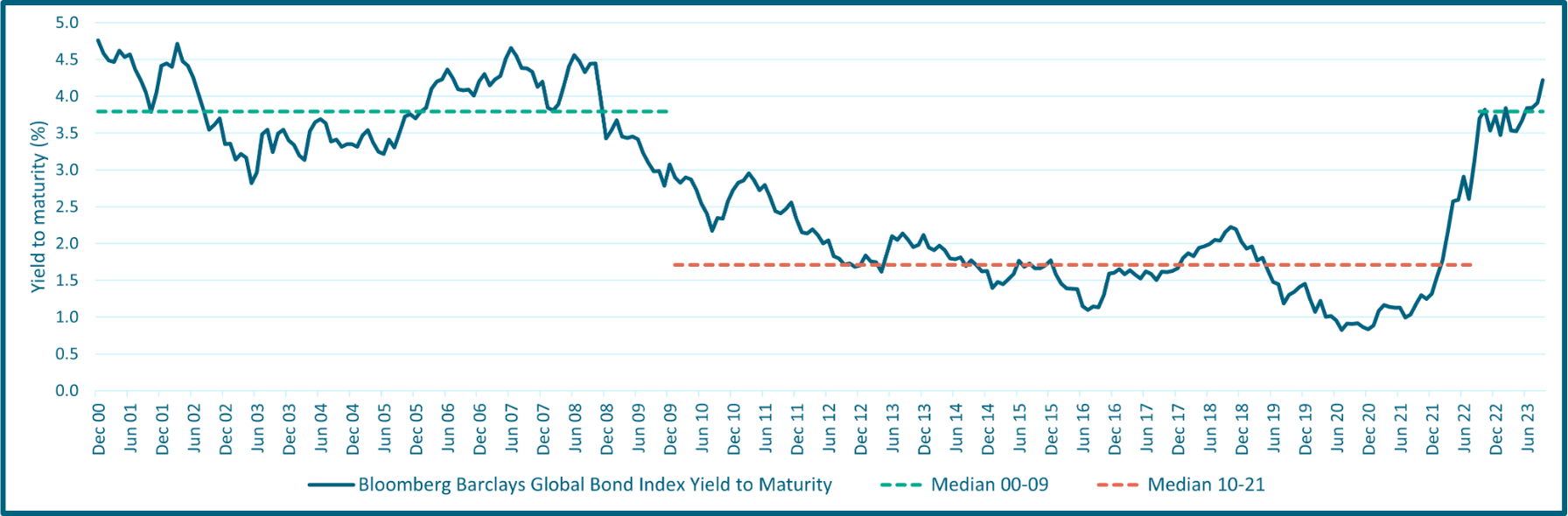

If those among us with a long memory look back, we can remember a time before the Great Financial Crisis of 2008, where the fixed interest part of our portfolios would churn out returns of between 5-6% on an annual basis (fig 1). We believe that the scene is set for a similar experience.

There are still risks for fixed interest markets. But if one takes a balanced and diversified approach, the rates of return are more attractive than having cash in the bank, where your money is safe but not keeping up with inflation. In fact, we could be back in a world where we’ve returned to some semblance of normality in bond markets (i.e. the pre-financial crisis level, shown by the green dotted line in fig 1 below).

We believe fixed interest prices and yields across the spectrum are sensible. And at a headline level, we would argue something similar in equities.

Global bond yields back to pre-2008 levels

Fig 1: Global bond yields are now back to pre-2008 levels. Yield to maturity of the Bloomberg Barclays Global Bond Index GBP Hedged from 2001 to current.

Source: CGWM, Bloomberg

Equity market outlook 2023

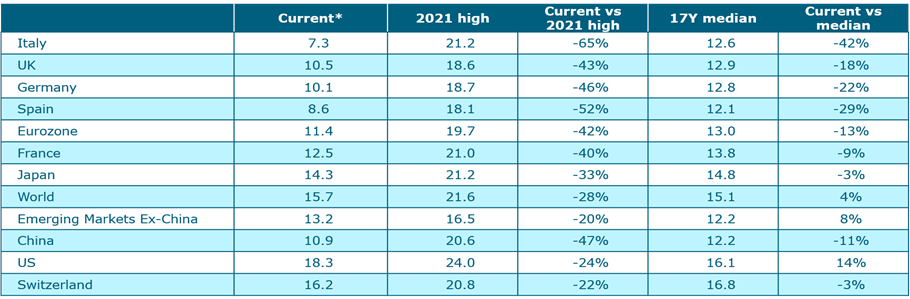

We no longer believe that investor enthusiasm for equities is excessive on the whole - and this is reflected in valuations. This is another major change from the end of 2021 (see fig 2 below). Other markets around the world look better value than the US; currently, we like UK equities, Chinese equities, elements of ‘value’ equities and specific thematic investments. It is also worth noting that many investments that have been hyped up over the last few decades are currently in the doldrums.

Equity market valuations

Fig 2 illustrates the drop in equity market valuations, by region, from their 2021 high to their current valuation levels.

Perhaps Asia is the best example of this. A decade ago, if you didn’t profess that Asia and China were 'the future', you were considered an investment dinosaur. Now, if you speak positively about future returns, people recoil in terror and think you've lost it for suggesting something so dangerous. And, after a long period of relative (and, in the case of China, absolute) disappointment, who can blame them?

Asia has moved from an investor darling to an investor pariah over the last few years. Asset prices have fallen, valuations have been squeezed and sentiment has deteriorated rapidly. However, this creates a potential opportunity in the future.

Fig 2: Current 12-month forward price to earnings (P/E) ratios of major global markets compared to their 2021 P/E highs and 17-year (long-run) median average, shown in local currency terms.

Source: CGWM, Bloomberg *as at 17/10/23

The price to earnings (P/E) ratio measures a company’s current share price against its earnings per share (in local currency terms). Using sterling as an example, it shows how much investors are willing to pay for each pound the company earns, i.e., if a company has a P/E ratio of 15, investors are happy to pay £15 for every £1 of earnings. A high P/E ratio suggests that investors are optimistic about the company's future growth, while a low P/E ratio means they are less certain.

Identifying attractive investment sectors

At a sector level, we have recently seen a lacklustre performance in several of the key themes that underpin our investment strategy. 2023 has been a relatively poor period for defensive equities, such as healthcare, infrastructure, and renewable technology, as some longer-term performance has been lost due to their sensitivity to rising interest rates (as investors moved to bonds to take advantage of higher yields).

In our opinion, this is an exciting development, and creates another opportunity. Valuations are very attractive; sentiment is poor and the potential for further damage from rising bond yields is limited. In addition, the outlook for dependable profits growth from these defensive equities has strengthened in the last few years.

Guiding you to investment success

When we examine our client portfolios and look at how we can make the most of the present circumstances, we become more comfortable about the balance of investment risks and rewards. A lot has changed in the past few years and the current situation for investors is unnerving, but we still believe that the key to investment success is buying good assets at attractive valuations and holding them for a sensible period. We intend to continue with this philosophy, regardless of whatever the ‘turbulent twenties’ can throw at us.

If you have any questions about the current market and economic environment or about your investments, please get in touch with your usual CGWM adviser or email: questions@canaccord.com

For further information on any of the terms used in this article please see our glossary of investment terms.

Investment Outlook February 2024

Read our latest Investment Outlook to discover which investment sectors can provide attractive returns while helping to offset recent market and economic volatility.

You may also be interested in:

- Why staying invested is better than moving to cash

- Has the pharmaceutical industry discovered a cure for obesity?

- Webinar: seeking attractive investment opportunities for our clients

New to Canaccord Genuity Wealth Management?

If you are interested in finding out what the latest investment outlook means for you, we can put you in touch with an expert that can help.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

This is not a recommendation to invest or disinvest in any of the companies, themes or sectors mentioned. They are included for illustrative purposes only.

The information contained herein is based on materials and sources deemed to be reliable; however, Canaccord Genuity Wealth Management makes no representation or warranty, either express or implied, to the accuracy, completeness or reliability of this information. Canaccord is not liable for the content and accuracy of the opinions and information provided by external contributors. All stated opinions and estimates in this article are subject to change without notice and Canaccord Genuity Wealth Management is under no obligation to update the information.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.