The secrets of calculating a wealthy retirement

There’s no better time than now to plan for your retirement. Retirement planning is essential in the UK: we're enjoying longer retirements than ever before, primarily because we’re living longer. This extended retirement period must be conscientiously planned and funded — and we must each take personal responsibility for it. In this article, our independent wealth planners offer their secrets to planning a wealthy retirement.

Don’t rely on the government for your retirement planning

When you start planning for retirement, you can’t rely on your state pension. You can’t rely on the government to support you in old age — it’s up to you to make your own arrangements and plan carefully to ensure you can enjoy your later years in the comfort that you aspire to.

If we are to realise our aspirations and attain our desired quality of life in later years, we simply need bigger pension pots than before. Even more importantly, we need to start planning for retirement as early as possible.

Start planning for retirement by calculating how much you think you’ll need

Clients always ask us when they start planning for their retirement: “will I be able to retire when I want to? Will I run out of money? How can I guarantee I’ll have the kind of retirement I want?” Because no-one knows exactly how long they’re going to live or what financial challenges they may face, these are hard questions to answer. Pensions, as one aspect of planning a wealthy retirement, can be complex with so many considerations, including your family circumstances, pension rules and tax regulations.

Firstly, you’ll need to work out how much you have already saved and how much more you can afford to set aside. Then assess how much you think you’ll need to maintain your desired lifestyle and how long you realistically might live — and compare the two. This is an exercise that our independent financial planners often undertake with clients when discussing their retirement plans.

We can also build a personalised cash flow forecast for you, which looks at your current wealth alongside your income. We also run different scenarios to see how they might work to fund your retirement.

If you would like to carry out your own assessment, use our calculator below to quickly and efficiently see how much money you’ll have in retirement.

Calculate how much money you'll have when you retire

Take advantage of your workplace pension

Whether you’re employed, a partner, or self-employed, you can contribute into a pension. Employers are legally bound to offer workers access to a pension scheme, while anyone self-employed or unemployed, who can’t invest in an occupational plan, can pay into a personal pension, such as a SIPP (Self Invested Personal Pension) or a stakeholder policy.

Pensions are the most tax-efficient wrappers available to investors, with up to 45% income tax reclaimable on contributions. What’s more, many employers see their defined contribution workplace pension schemes as a valued and affordable benefit, so they offer generous contributions to their employees. If you’re an employee and not currently a member of your company’s pension scheme, ask your HR department for details.

For more details about how much you can contribute to your pension, and for details of the annual pension allowance, read our expert information.

Start saving for retirement when you’re young

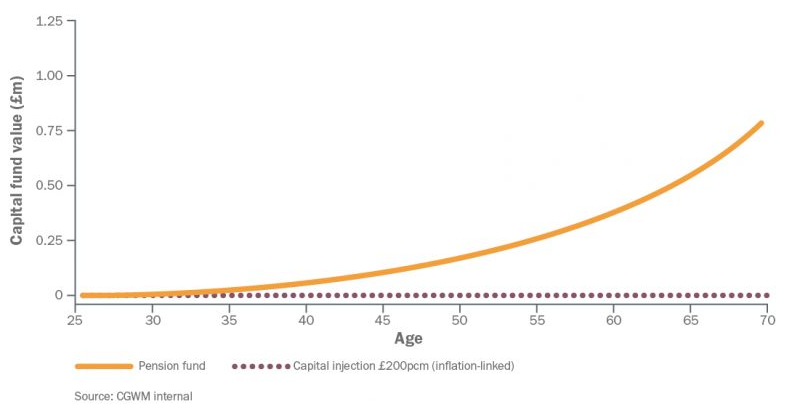

By investing at a young age, you can also help ensure a comfortable retirement. As the graph below shows, a 25-year-old contributing £200 each month (including employer contribution) can generate a healthy pension to supplement their state pension.

If they were to contribute £200 per calendar month until the age of 68, rising in line with inflation at 3%, and if that pension generated returns of 5.75% per annum, they’d have a fund of £741,337 on which to retire.

Be aware of changes to the pension rules

Saving in a pension is one of the most tax-efficient ways to invest for your future. But to many people, pension rules seem like a minefield, and recent changes in pension legislation have made this complexity even more challenging.

Firstly, the Lifetime Allowance (LTA) tax charge has now been removed, as of 6 April 2024. Previously, anyone withdrawing benefits from their pension fund above the LTA of £1,073,100 (or the applicable fixed protection amount) was subject to a tax charge. This could be either 55% or 25%, depending on whether they were taking a lump sum or income. The Spring budget in March 2023 reduced this charge to 0%. The Autumn statement 2023 confirmed that the LTA would be removed entirely from 6 April 2024, and this has now taken effect.

As a result, you can now theoretically add to your pension (within set limits) without worrying about a penal tax charge if you breach the old LTA. Consequently, if you have had to stop paying money into your pension fund to avoid this tax, there’s now a chance to add more.

Secondly, the maximum annual contribution is being increased from £40,000 to £60,000 – although this is reduced for high earners. It’s worth noting that this legislation could change again now a new Labour government has been elected — so the opportunity could be time-limited.

What can I do if I don’t have as much as I want?

Part of the answer to this could come from planning to work for longer. If you factor in some part-time income for a few extra years, you can supplement your savings and pension, helping them go further, and you may even be able to build extra savings too.

These calculations are not straightforward and, of course, you will need to make assumptions about how much you can expect to earn on your savings and investments, which a financial planner may be able to help you with.

Our quick tips and secrets to retirement planning

- Start early – average life expectancy in the UK is getting higher, making retirements longer, so we need more money for later life

- Take responsibility for your own financial future – final salary pension schemes are far less common than they were so the burden is falling on ourselves and not our employers

- Save what you can – a little regular saving now goes a long way in the future

- Regularly check that your plans are still on track – if your circumstances change you may need to adjust your retirement options

- Seek advice when you need it – financial planning can be complicated, especially further down the line when you may have multiple pension pots or more complex requirements. Free pensions advice is available from Pension Wise (an impartial government service to help you understand your pension options) — or a financial planner can look at your individual situation to ensure all your investments are working in line with your long-term needs.

If you’d like to speak to a Wealth Planning specialist at Canaccord to discuss your plans for retirement in more detail and find out how much money you need and you’ll have when you do retire, let us contact you.

Want to review your retirement planning?

Arrange a no-obligation, complimentary consultation with an independent wealth planner now.

You may also be interested in:

- How we talk about money: part one

- How we talk about money: part two

- How we talk about money: part three

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

The tax benefits depend upon the investor’s individual circumstances and clients should discuss their financial arrangements with own tax adviser before investing. The levels and bases of taxation may be subject to change in the future.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.