Wealth planning: will you be able to afford rising care home costs?

Care home fees rose by 11% in 2023, according to recent research - taking annual fees to an average of £45, 897 across the UK.1 Are you and your family prepared?

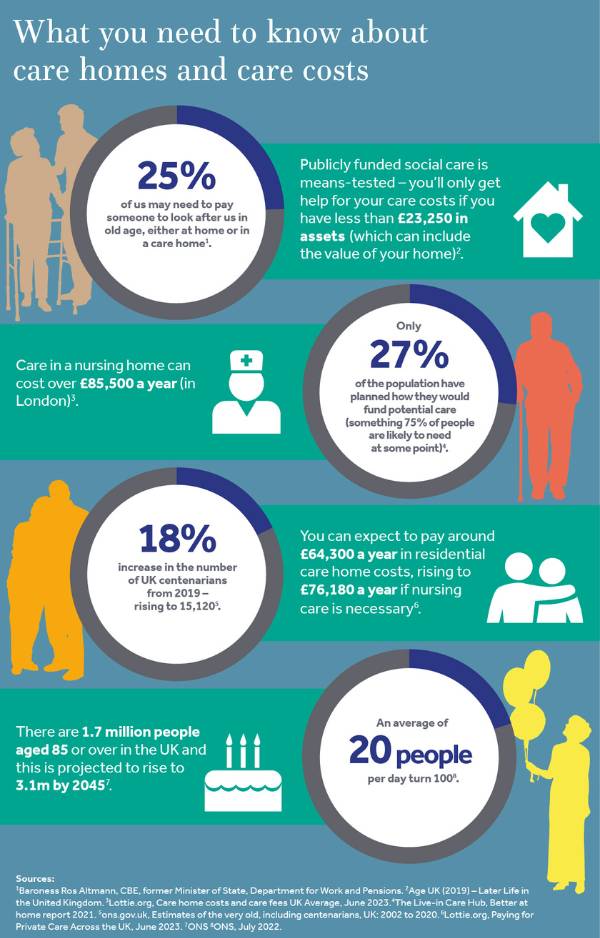

Although we all know the cost of care in later life could be significant, few people realise the true extent of care home costs, or adequately plan how to pay for them. Having a comprehensive wealth strategy in place can ensure you are financially prepared if you require long-term care in the future.

In England, unless you have significant ongoing health needs, people with assets worth more than £23,250 are currently expected to pay their care home costs themselves.

The current government, back under Boris Johnson, did announce a proposal to increase this threshold to £100,000, along with a lifetime cap of £86,000 on personal care costs. This was initially proposed to be introduced in October 2023, but was consequently pushed back to October 2025 – and given the upcoming election, there is no guarantee that this proposal will ever come into effect.

Even if the next elected government did stick to the proposal, it is worth noting that the £100,000 asset threshold is means-tested, and could include the value of your home. And don’t forget, the £86,000 cap is only on personal care costs – meaning that individuals would still be expected to pay for all other care-related costs, including accommodation, food, utilities and consumables.

At CGWM, we are not expecting legislation around care home fees for wealthy individuals to change dramatically, no matter the results of the looming election. Instead, we would encourage making contingency plans for your care costs, whether that is for a care home or care at home. Having money earmarked for your later life care could give you greater peace of mind and the means to choose the best option.

1https://ukcareguide.co.uk/rise-in-care-home-costs/

What you need to know about care homes and care costs

How can you plan ahead for care costs?

If you are worried about later life care costs, whether for yourself or an older family member, expert wealth planning can help you set up a care costs plan. This will give you peace of mind and save you and your family worrying about how you will manage to pay for your care home costs, if and when the time comes.

If your circumstances change and residential care is needed for you or another family member, it’s so important to make sure your adviser takes a holistic view of your total wealth. They can set up a financial care costs plan to see you, or your family member, comfortably through the rest of life. There are a number of ways this can be achieved, including care home tax planning for capital maintenance and help with your inheritance plans, or an annuity for care home fees.

Care home tax planning: This involves implementing strategies to manage the tax implications associated with funding and paying for care home expenses. These strategies aim to optimise financial resources while ensuring that individuals receive necessary care without undue tax burdens.

Annuities for care home fees: These are financial products designed to help individuals cover care home costs in retirement. With a care home annuity, you pay a lump sum of money to an insurance company, just like buying any other annuity. In return, the insurance company pays you a regular income for the rest of your life. The cost of an annuity is based on an assessment of your medical records (including your life expectancy), and the calculated annual income.

It's worth noting that annuity income can also be tax free if it’s paid directly to a registered care provider. They also offer flexibility, including options for spouses and inflation protection.

Seek advice on how to plan now and pay later for your care costs

Of course, when you or any other family members need care, planning what to do can be very stressful. You’ll be faced with many decisions and may be unsure where to start or who to talk to, particularly when it comes to sorting out how to pay for care as long as it’s needed.

At Canaccord Genuity Wealth Management, in our team of independent Wealth Planners we have experts who are specially qualified to provide advice in this area and some who are trusted accredited members of SOLLA (Society of Later Life Advisers). Please contact us if you would like an initial conversation to discuss your personal circumstances or for a family member who might need to go into a care home. We can set up a video call to include different family members if that would help.

How you can structure your wealth to meet care home costs

The following example shows how restructuring your wealth can help maximise income to cover care home fees, while maintaining your capital tax-efficiently for inheritance purposes.

Janet Smith, aged 80 and widowed, is in poor health. Her husband, Brian, died five years ago and left everything to her.

After Brian’s death, her daughter Alison became increasingly worried that Janet wasn’t coping at home alone. Together, they agreed it would be best for Janet to move into a local care home where she could get the care she needed.

This was a stressful time for Janet and Alison, and they decided to seek specialist advice. Fortunately, Janet had registered a ‘property and financial affairs’ Lasting Power of Attorney naming Alison as her attorney. This allowed Alison to deal with the money side of things without creating more worries.

Janet’s income of £25,000 per year after tax is made up of her teacher’s and state pensions. However, her care home fees will be £88,000 each year, which obviously creates a shortfall. This is likely to widen as the care home costs rise each year.

Janet also has £2m in existing savings and from the sale of the family home – but naturally she wants to leave as much as possible to her family.

Our care home financial plan for Janet

- Set up a £400,000 care fees annuity to provide £66,000 pa (guaranteed for life), rising by 5% pa*.

- Keep £100,000 in cash for emergencies.

The first priority is to cover Janet’s care fees. The immediate care annuity would increase each year by 5% to cover the rising care costs – obviously the care costs might increase by more than 5% each year, but at least this should help. She would also benefit from capital protection, which would repay a portion of the lump sum if she were to die within six months. As this income is paid directly to the care home, it’s tax free. This would also apply if Janet were receiving care at home from a registered care provider.

We always recommend keeping a cash buffer for emergencies, which would usually be calculated to provide between three and six months’ income. However, as Janet is retired and in care, our specialist advised her to set aside a larger amount.

The remaining £1.5m could be distributed across a combination of the following:

- As the care costs are now being covered, Janet could provide outright gifts to her family (see Making gifts to her children below).

- She could invest some funds in her own name, in case the care costs increase faster than expected, or if she needs extra nursing care.

- Invest in inheritance tax (IHT) efficient assets making use of Business Relief – these should become free of IHT liability after two years.

- Place some assets in trust – these should become IHT free after seven years.

Janet’s choice of solutions will depend on a number of factors, including her health, how much control she wants to retain, whether she might need further income in the future, and her attitude to risk.

* This is an indicative cost and we review each case individually, considering each client’s health and their ability to undertake daily activities, as well as other variables.

Making gifts to her children

An outright gift must be made without reservation and Janet needs to live for seven years after making it if she wants it to remain free of inheritance tax. If she dies within that time, it will be included in her estate for IHT purposes and her family will have to pay tax on it.

If Janet starts to lose her capacity for making decisions, her ability to transfer assets will be severely curtailed.

We also made sure that Janet was claiming what she was entitled to (e.g. attendance allowance). If her condition deteriorates, Alison should ensure that Janet’s position is assessed again to see if she is entitled to NHS Continuing Healthcare.

This is for illustrative purposes only and not to be treated as specific advice. This case study is based on our current interpretation of inheritance tax rules. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity. Tax benefits depend upon the investor’s individual circumstances and clients should discuss their financial arrangements with their own tax adviser before investing. The levels and basis of taxation may be subject to change in the future.

More information on this topic

If you want to read more about inheritance tax planning, please read the following articles:

- AIM to manage IHT - the advantages of investing in the Alternative Investment Market

- Gifting out of surplus income to reduce inheritance tax

- Cash flow modelling for retirement

Let us contact you

If you're unsure which of our teams to contact, let us help you. We can put you in touch with one of our experts who will discuss your wealth management needs with you.

Important information: This is for illustrative purposes only and not to be treated as specific advice. This article is based on our current interpretation of inheritance tax proposals. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity. Tax benefits depend upon the investor’s individual circumstances and clients should discuss their financial arrangements with their own tax adviser before investing. The levels and basis of taxation may be subject to change in the future.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

This is not a recommendation to invest or disinvest in any of the companies, themes or sectors mentioned. They are included for illustrative purposes only.

The information contained herein is based on materials and sources deemed to be reliable; however, Canaccord Genuity Wealth Management makes no representation or warranty, either express or implied, to the accuracy, completeness or reliability of this information. Canaccord is not liable for the content and accuracy of the opinions and information provided by external contributors. All stated opinions and estimates in this article are subject to change without notice and Canaccord Genuity Wealth Management is under no obligation to update the information.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.