Cautious investment portfolios in volatile times

The cautious conundrum – can lower-risk investments see good returns?

This year has certainly proved challenging for investors, with extreme inflationary pressures, supply chain problems and rising interest rates.

These challenges mean that investors who hold ‘cautious’ (lower-risk) portfolios may have witnessed volatility in their performance. With inflation expected to remain at elevated levels well into 2023, and the likelihood of still tighter monetary policy to combat it, the era of ultra-cheap borrowing could be over. How can investors navigate the risks this presents, and how can we, as investment managers, ensure those cautious investment portfolios can still deliver for investors?

How has market volatility affected cautious portfolios?

Prevailing market conditions have meant that some conventional cautious multi-asset portfolios – typically those with c.70% allocated to low-risk assets – may appear to be struggling to preserve capital as effectively as they have historically. There is also a risk that equities and bonds could become much more correlated than usual. Bonds and equities are typically inversely proportionate – i.e., when bonds go down, equities often rise and vice versa. However rising inflation and interest rates are causing investor nervousness and price falls in both bond and equity markets.

For some time, part of the case for choosing risk assets like equities has been that there was no alternative to achieving a higher yield while bond yields were so low - but this argument may now be harder to make: bond yields are now rising as the price of bonds is falling. Lower-risk assets, such as government and investment grade corporate bonds, have suffered notable capital losses – particularly longer-duration assets, because they have a greater sensitivity to interest rate hikes.

Our cautious portfolio asset allocation strategy

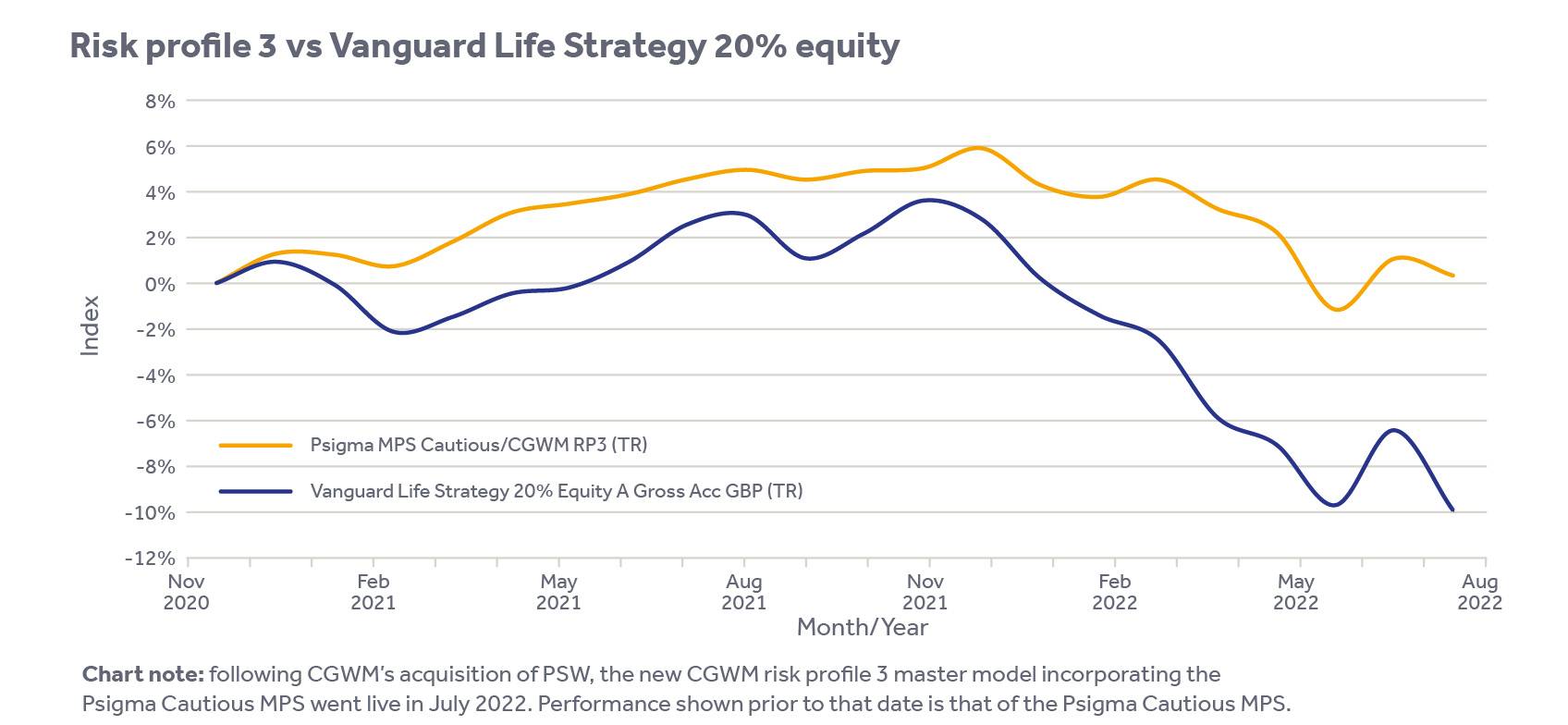

At Canaccord Genuity Wealth Management (CGWM), our strategy for cautious and lower-risk portfolios is to take a very active approach to asset allocation and stock selection, which is benefiting our cautious/lower-risk profiles (see charts below). We are opting for shorter duration assets, which are better able to withstand rising interest rates, and choosing investments that offer fixed income returns.

The benefits of our approach are visible: through careful selection of bonds, the CGWM risk profile 3 portfolio has outpaced the performance of the Vanguard Life Strategy 20% fund, which could be considered as a directly comparable low risk fund (the CGWM risk profile 3 and Vanguard Life Strategy fund are both comprised of 20% equities and 80% lower-risk assets).

What is the outlook for cautious or lower-risk investment portfolios?

We expect both bond and equity markets to remain volatile, and we believe it will pay to allocate to the appropriate/relevant opportunities carefully and selectively, as and when they present themselves. However, prospective returns from bonds – and by extension lower-risk portfolios, because they typically have a higher exposure to bonds – are potentially more attractive than they have been for some time. For a protracted period it has been challenging to see how fixed income securities would deliver positive real returns for investors after costs, but this may now be changing.

How are government bonds performing compared to corporate bonds?

Rising government bond yields, coupled with a widening in credit spreads, is offering investors more attractive yields than we have seen for a number of years, offering a better risk/reward dynamic.

At present, corporate bonds provide attractive opportunities, with some investment-grade issuers currently offering higher equity-like returns because of the rise in yields. While corporate bonds carry greater credit risk than government bonds such as UK government gilts (fixed interest loan securities issued by the UK government), corporate balance sheets are generally in good shape, with most companies showing little sign of having overstretched themselves. Corporate debt defaults therefore remain low. Following the moves we have seen in bond markets in the year-to-date, the potential upside now appears more evenly balanced with the potential downside.

How are central banks reacting to raised inflation rates?

Although opportunities have begun to open up, fixed income markets are unlikely to be out of the woods entirely. Inflation has remained elevated for longer than market commentators expected, and central banks are likely to stay in monetary tightening mode for a little longer. It is imperative to be highly selective, to be well diversified across bonds, and to choose assets with a shorter duration (i.e. length of time until redemption or maturity). We have certainly benefited from positioning our cautious discretionary model portfolios to short-duration assets and a lower proportion of gilts, but we continue to review our positioning and will adjust our allocations as and when conditions evolve further.

How could the global economic situation affect bonds in the future?

Despite some positive signs, the wider global economic situation remains very uncertain and recession is an increasingly real possibility – particularly if central banks continue to prioritise inflation over growth and employment. However, the better risk/reward trade-off outlined above should mean that bonds will once again offer greater capital protection benefits. If central banks increase interest rates at a quicker pace and/or to a higher level than markets are currently anticipating, bond yields could rise further still.

Even so, the significant move in yields this year should reduce the chances of suffering further major capital losses and see the less correlated relationship between equities and bonds re-establish itself.

How are equities performing?

Of course, cautious portfolios will still include equities. And the sell-off in stock markets since the start of the year could also present opportunities for cautious investment portfolios. In the year-to-date, we have seen fairly indiscriminate falls in ‘growth’ stocks* in the wake of interest rate rises, while ‘value’ stocks** have significantly outperformed their growth peers on a relative basis.

As global equity investment experts, at CGWM we believe that equities deliver the best real returns over the long term, a view that is supported by evidence. Our long-term active approach to equities allows time for markets to correct pricing inefficiencies in our discretionary clients’ favour. Importantly, it also allows us to ride out the volatility inherent in equity investing.

Which sectors could perform best?

Performance has varied across different types of company, so we are careful about the industries and companies we invest in. Energy stocks have outperformed, while other sectors (e.g. utilities) have also contributed to relative returns. However, some more cyclical sectors have suffered with the prospect of recession.

The outcomes for differing styles and sectors within equity markets will depend on geopolitical and economic factors – but defensive*** dividend-paying stocks, often staples of the equity allocation in cautious portfolios, should still be appealing. While inflation is high and stagflation remains a concern, reliable dividend streams could well command a premium, so in equities we focus on long-term assets, taking a thematic approach and investing in areas such as infrastructure and healthcare, which we believe will continue to perform strongly against rising inflation.

You may also be interested in:

How we can help

If you would like any further information, please get in touch with your usual contact. If you are new to Canaccord Genuity Wealth Management, please use the contact button below to get in touch with us.

Need more help?

Whatever your needs, we can help by putting you in contact with the best expert to suit you.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

This is not a recommendation to invest or disinvest in any of the companies, themes or sectors mentioned. They are included for illustrative purposes only.

The information contained herein is based on materials and sources deemed to be reliable; however, Canaccord Genuity Wealth Management makes no representation or warranty, either express or implied, to the accuracy, completeness or reliability of this information. All stated opinions and estimates in this document are subject to change without notice and Canaccord Genuity Wealth Management is under no obligation to update the information.

* ’Growth’ stocks are companies that are expected to deliver better than average organic revenue and earnings growth over the medium term.

** Investors looking for ‘value’ seek out stocks which they believe have been undervalued by the market

and are trading for less than their intrinsic worth. They are viewed as trading at a lower price than

justified when measured against metrics such as earnings, profit margins or sales.

*** Defensive stocks typically give stable earnings to investors regardless of trends in the stock market.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.