Our investment outlook for 2024

The keys to long-term investment success

Let’s start with some brutal honesty. The last two years have been disappointing for investment portfolios, even with the sharp recovery at the end of 2023. There have been small pockets of opportunity, but most core asset markets and wealth management indices have lost ground since the start of 2022.

To help navigate this period of uncertainty and volatility, we have reflected on recent experiences and considered whether we need to make changes to our current asset allocations. Instead of making assumptions based on what has happened in the recent past, we believe we should focus on undervalued assets, particularly in the equity sector, rather than those that have outperformed. This is often key to the future success of portfolio returns.

As we step into 2024 we need to consider a range of factors when shaping our asset allocations within client portfolios, while identifying opportunities that could increase future returns.

Are asset valuations still attractive?

The most important factor is always valuations. Of course it’s vital to consider whether the immediate economic outlook is rosy or rough, but that doesn’t matter nearly as much as the price one pays for an asset. Indeed, we would go as far as stating that the only real key to long-term investment success is buying sensible investments at attractive prices and holding them for a long time.

The good news for investors is that, despite the boost to prices enjoyed in the final two months of 2023, many investments remain attractive, particularly when compared to what was, in hindsight, the scarcity of value offered at the end of 2021.

Can fixed interest assets offer positive returns?

The shift to lower valuations, and thus the improvement in prospective returns in the last two years, is most obvious across fixed interest markets. This is an area of real strength at Canaccord Genuity Wealth Management (CGWM) and an asset class where we have traditionally achieved positive returns for our clients.

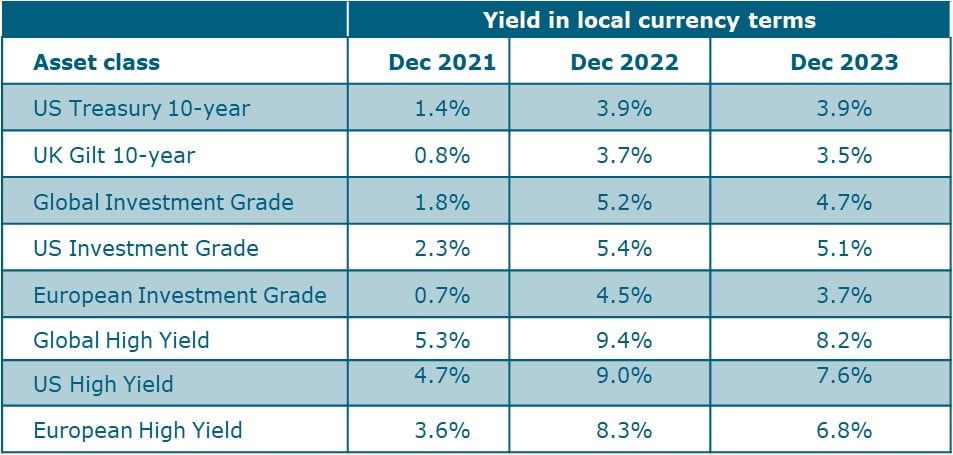

Even though 2023 ended up being an excellent year for fixed interest returns, it is worth noting that many fixed interest investments, including the most-watched US 10-year Treasury bond, offer yields close to where they were at the end of 2022 – and still substantially higher than they were at the end of 2021 (fig 1).

Based on current yields and our views of expected interest rates over the next few years, our forecasts for prospective returns imply that we should make:

- Around 4% per annum from government bonds in the coming years

- Between 5% and 6% in higher quality investment grade corporate bonds

- Closer to 8% in more speculative areas of global bond markets (i.e. bonds issued by companies perceived to have lower credit quality and higher default risk than more highly rated, investment-grade companies).

If we’re going to accept these moderately optimistic forecasts, we must also accept that there will be substantial volatility, as there has been throughout this turbulent decade so far, and there are both upside and downside risks to our predictions.

Fig 1: Changes in global fixed interest markets from December 2021 to December 2023

Source: CGWM, Bloomberg

We also believe that fixed interest returns will be aided this year by a major shift in the economic outlook. 2022 and 2023 were years of solid growth, particularly in the US economy, and while we expect growth to moderate this year, a damaging recession should be avoided.

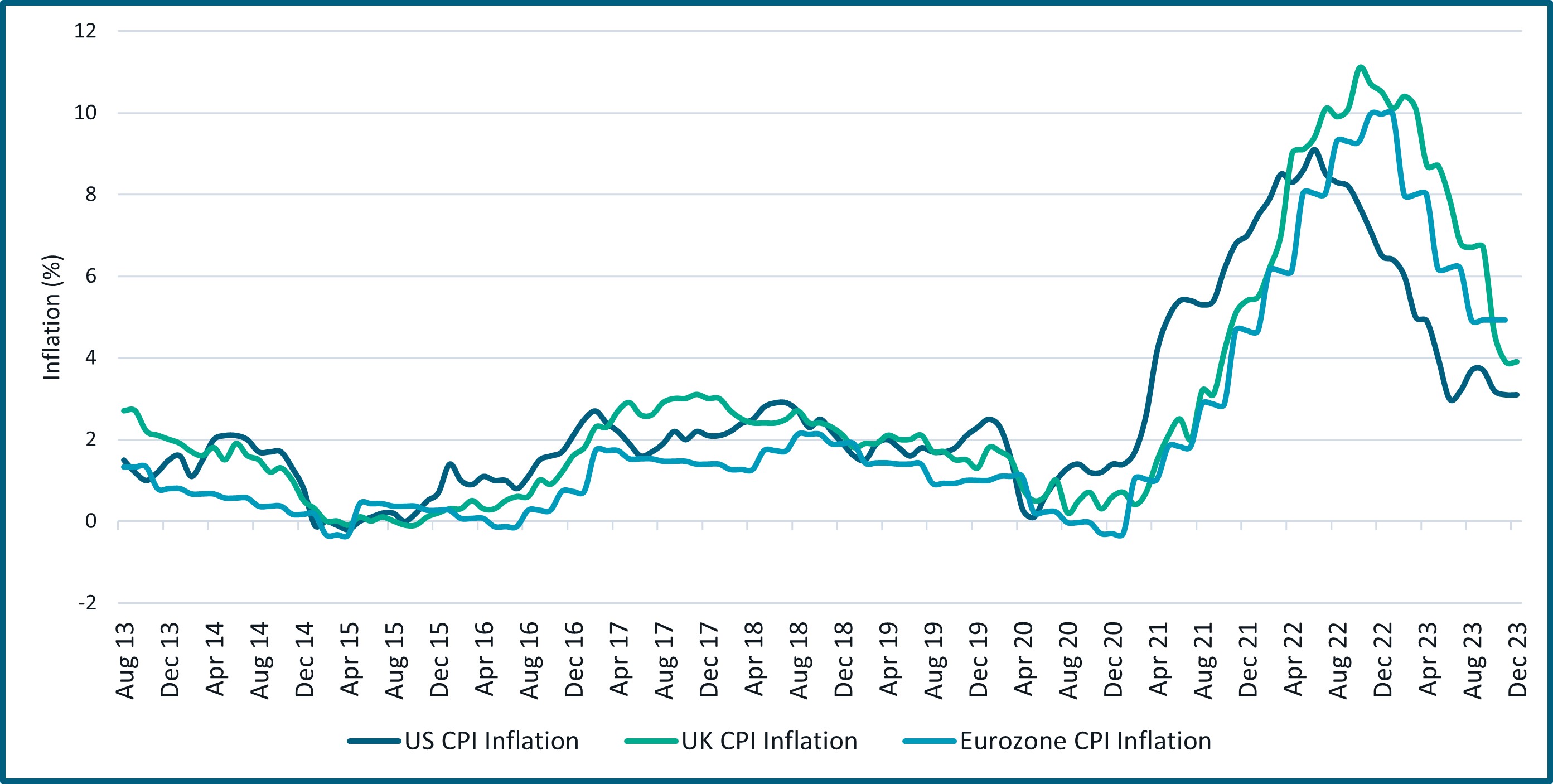

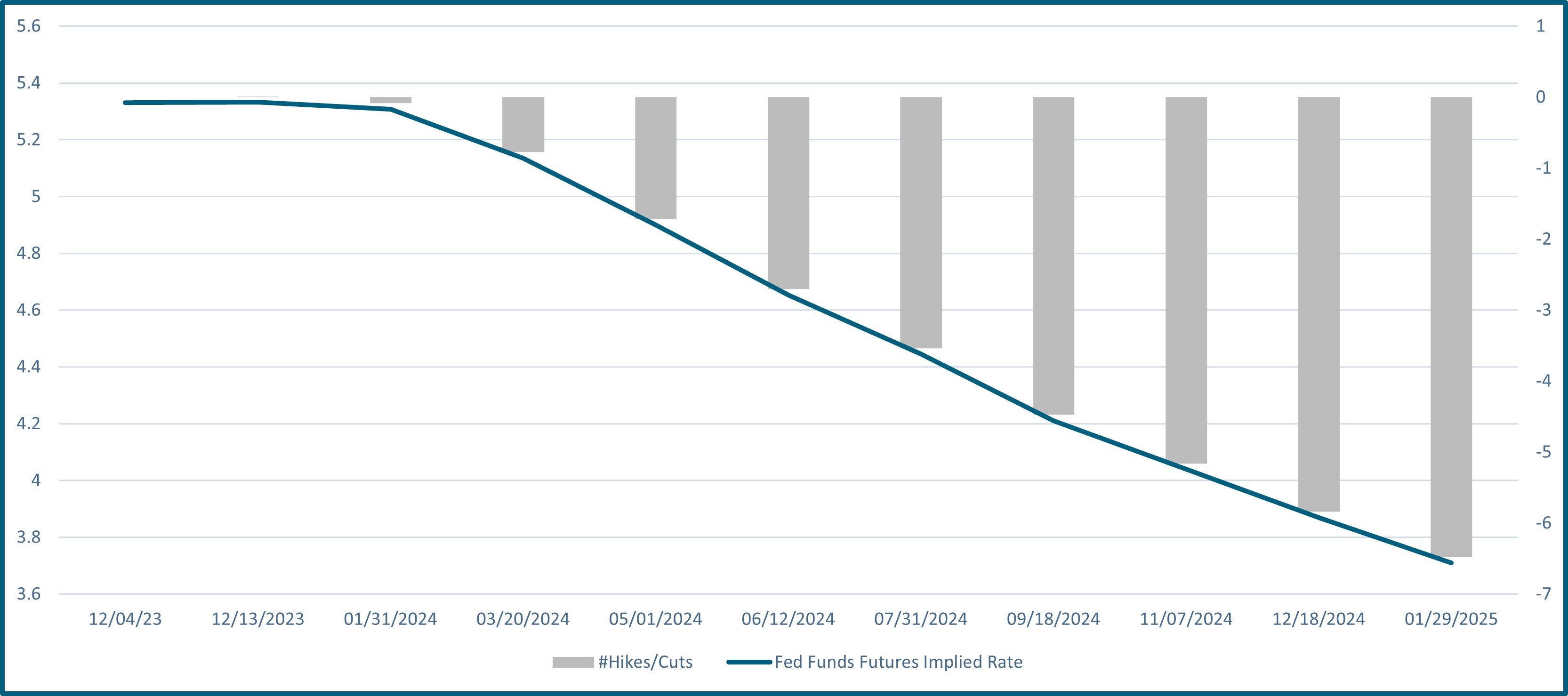

At the same time, we believe that we are most likely to continue to see a period of cooling inflation (fig 2). This will allow global central banks to pivot from their pursuit of ‘restrictive monetary policy’ and cut interest rates (fig 3) – clearly a positive turn after the experiences of 2022 and most of 2023.

Fig 2: Inflation rate movements in US, UK and Eurozone

Consumer Price Index (CPI) measures the overall change in consumer prices based on a representative basket of goods and services over time. The CPI is the most widely used measure of inflation.

Source: CGWM, Bloomberg

Fig 3: Federal Reserve actual and implied interest rate movements

Fed funds futures are financial market contracts that can be used by investors to observe the market's deduction about the probability of an interest rate change by the Federal Reserve. This information is often reported by the media, and investors can use this information to make investment decisions.

Source CGWM, Bloomberg

While our thesis will undoubtedly be tested along the way and we expect volatility to remain high, we believe this ‘goldilocks’ environment, where conditions are neither too hot nor too cool, should be favourable for making money in bonds.

Can equity markets still excite our interest?

The outlook for equity markets is more mixed, in our opinion, and a wide range of valuations will lead to a diversity of returns across different companies, sectors and regions. However, the simple fact is that we are currently finding plenty of different investment opportunities, with attractive valuations, that excite us.

If this positive bias is unnerving at a time of great uncertainty, we should stress that we are not being complacent. The year ahead will bring challenges on both a political and a geopolitical front. While we are far from convinced that the elections in the UK or US will bring a radical change in economic policy, they will add to the overall excitement. At the same time, the relationship between different countries and allied blocs is deteriorating, and this reversal of the globalisation theme of the last few decades is sure to contribute towards economic and market volatility.

Why are we confident in the positioning and asset allocations in our client portfolios?

Despite obvious threats, as well as the chance that the economic outcome is less benign than we have suggested, we have confidence in the positioning of our client portfolios. In order to counter these threats, where possible, we hold portfolios in a diversified and balanced manner and are positioned for a dull, but not disastrous, economic environment.

We have recently reshaped our portfolios to allow for a change in the direction of interest rates and a continued decline in levels of inflation. We expect to make positive returns from fixed income and believe there are obvious opportunities – at the right price – across equity markets. In short, to guide us through these volatile times, we believe we own a range of sensible investments at attractive valuations, which we intend to hold for a long time.

Any questions?

If you have any questions about the current market and economic environment or your asset allocation within your portfolio, please get in touch with your usual CGWM account executive or email: questions@canaccord.com.

For further information on any of the terms used in this article please see our glossary of investment terms.

Why healthcare and infrastructure sectors are still key portfolio components

Both healthcare and infrastructure stocks had a mediocre 2022 and, for the most part, a difficult 2023. However, we’re pleased to say we believe the case for investment in both remains almost entirely as strong as it was before the period of poor performance.

Discover our accompanying article to Investment Outlook February 2024.

You may also be interested in:

- UK equities: the silver lining to an otherwise gloomy outlook

- Webinar: balancing investment risk with opportunities in 2024

New to Canaccord Genuity Wealth Management?

If you are interested in finding out what the latest investment outlook means for you, we can put you in touch with an expert that can help.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

This is not a recommendation to invest or disinvest in any of the companies, themes or sectors mentioned. They are included for illustrative purposes only.

The information contained herein is based on materials and sources deemed to be reliable; however, Canaccord Genuity Wealth Management makes no representation or warranty, either express or implied, to the accuracy, completeness or reliability of this information. Canaccord is not liable for the content and accuracy of the opinions and information provided by external contributors. All stated opinions and estimates in this article are subject to change without notice and Canaccord Genuity Wealth Management is under no obligation to update the information.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.