Beyond 60/40: rethinking portfolio construction

Investing, like chess, is about striking a balance between risk and reward. As five-time World Chess Champion Magnus Carlsen said, "Not being willing to take risks is an extremely risky strategy". While the objective in chess is to outmanoeuvre your opponent while protecting your own pieces, in investing, our goal is to maximise returns within a given level of risk.

A skilled chess player considers not only the capability of a single piece, but how the pieces work together to foster a positional advantage. Similarly, effective portfolio construction requires assessment of not just the individual risk-reward potential of each investment, but how those investments interact. A portfolio is not a collection of standalone ideas; it must be meticulously designed with complementary positions.

Equities and bonds: the perfect couple

Historically, investors have relied on the complementary nature of equities and bonds to balance risks. High-quality government bonds tend to be negatively correlated to equities. During equity downturns – often surrounding weaker economic situations like a recession – inflationary pressures are generally low, and policymakers cut interest rates to stimulate growth. Simultaneously, as risk appetite declines, investors sell risky equities in a ‘flight-to-safety’ towards government bonds. Consequently, bonds provide protection – moderating equity risk and dampening portfolio volatility. If bonds can be bought at attractive yields, an investor is effectively being paid to insure an equity portfolio.

This method of portfolio construction is called ‘Modern Portfolio Theory’ and is utilised by traditional multi-asset investors around the world. The 60% equity, 40% bond portfolio (60/40) is widely considered to provide optimal risk-reward.

The great duration trade

For three decades, 60/40 has been an excellent strategy. A period characterised by low and steady inflation providing a stable backdrop for economic growth and asset appreciation. A period of relative peace and cooperation with low inflation driven by globalisation. The integration of national economies into the international economy through trade, foreign investment, capital flows, migration, and the spread of technology has improved economies of scale.

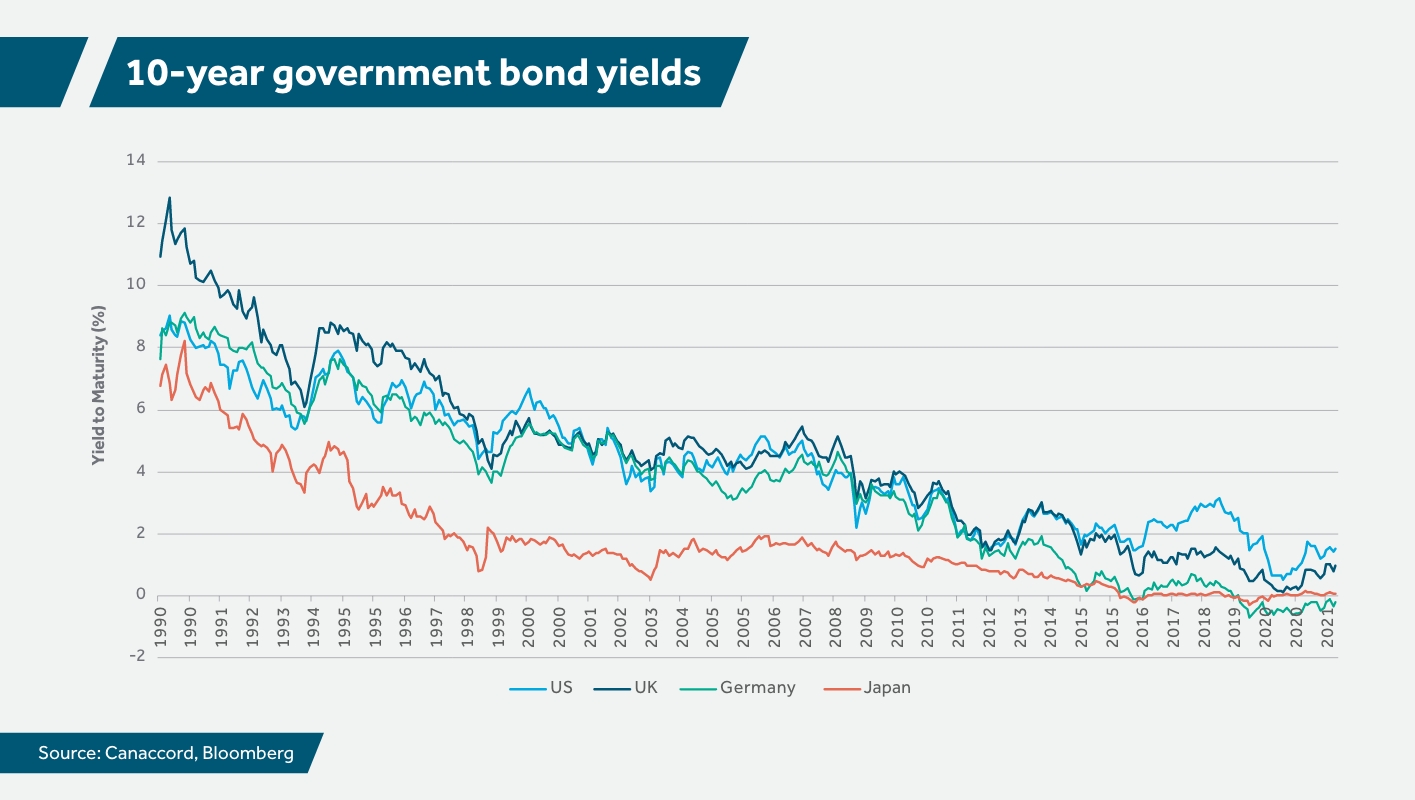

These dynamics facilitated a prolonged period of falling interest rates and bond yields, as shown in the graph below. This downward trajectory meant money became cheap, fuelling investment and spending.

Graph: 10-year government bond yields. Source: Canaccord, Bloomberg.

A new correlation regime

While these conditions supported the 60/40 portfolio, recently, complications have arisen. During the pandemic, interest rates were cut to effectively 0%; central banks forced bond yields lower, through Quantitative Easing (QE), leaving them exposed to interest rate risk and offering very little yield. At the end of 2020, almost a third of global bonds were trading with negative yields. Investors were paying to lend money!

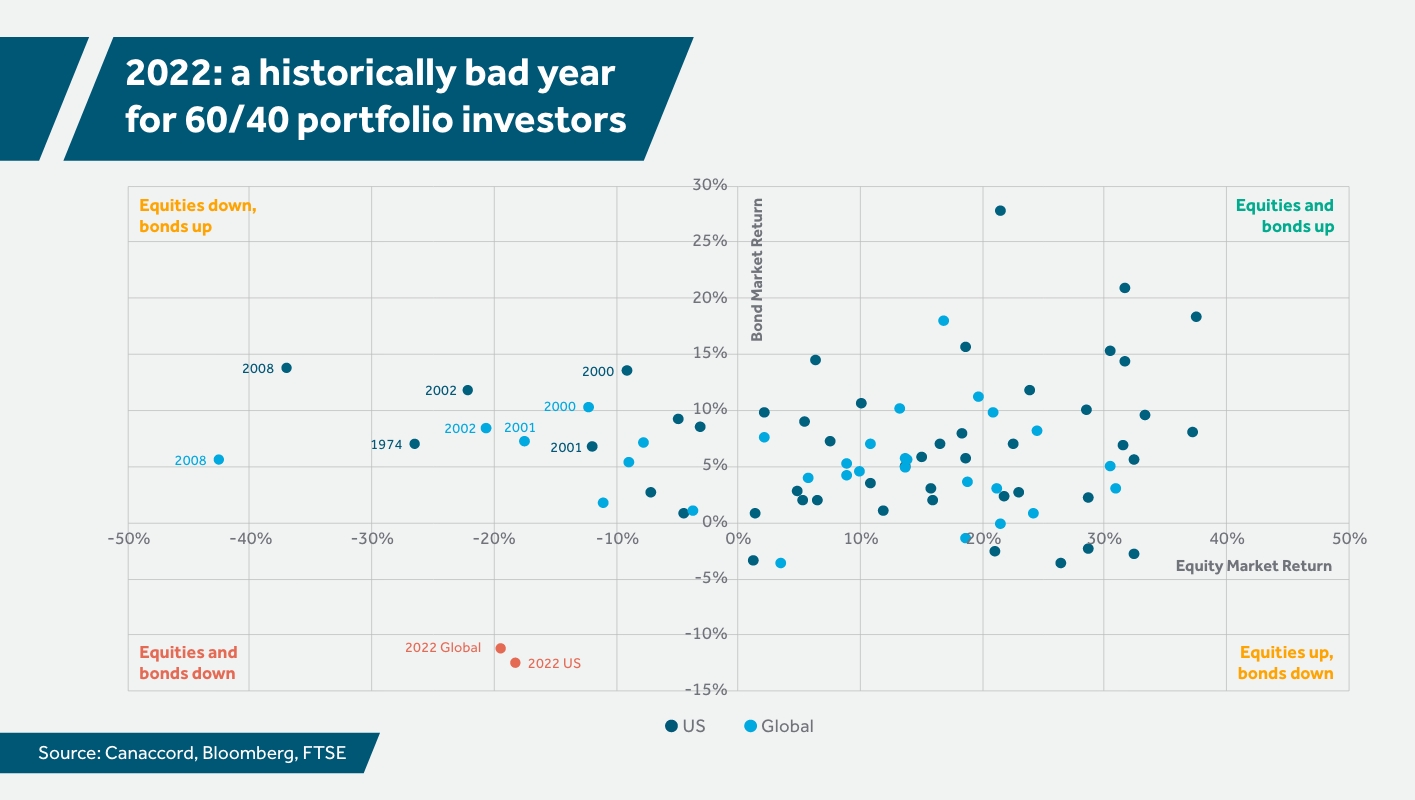

A period of inflation and a reversal of ultra-loose monetary policies had disastrous implications for traditional multi-asset investors still relying on bonds for diversification. These investors suffered the worst performance in living memory in 2022 – the first year in modern history in which bond and equity markets declined together, as shown on the graph below.

Graph: This highlights that 2022 was a historically bad year for 60/40 portfolio investors. Source: Canaccord, Bloomberg, FTSE.

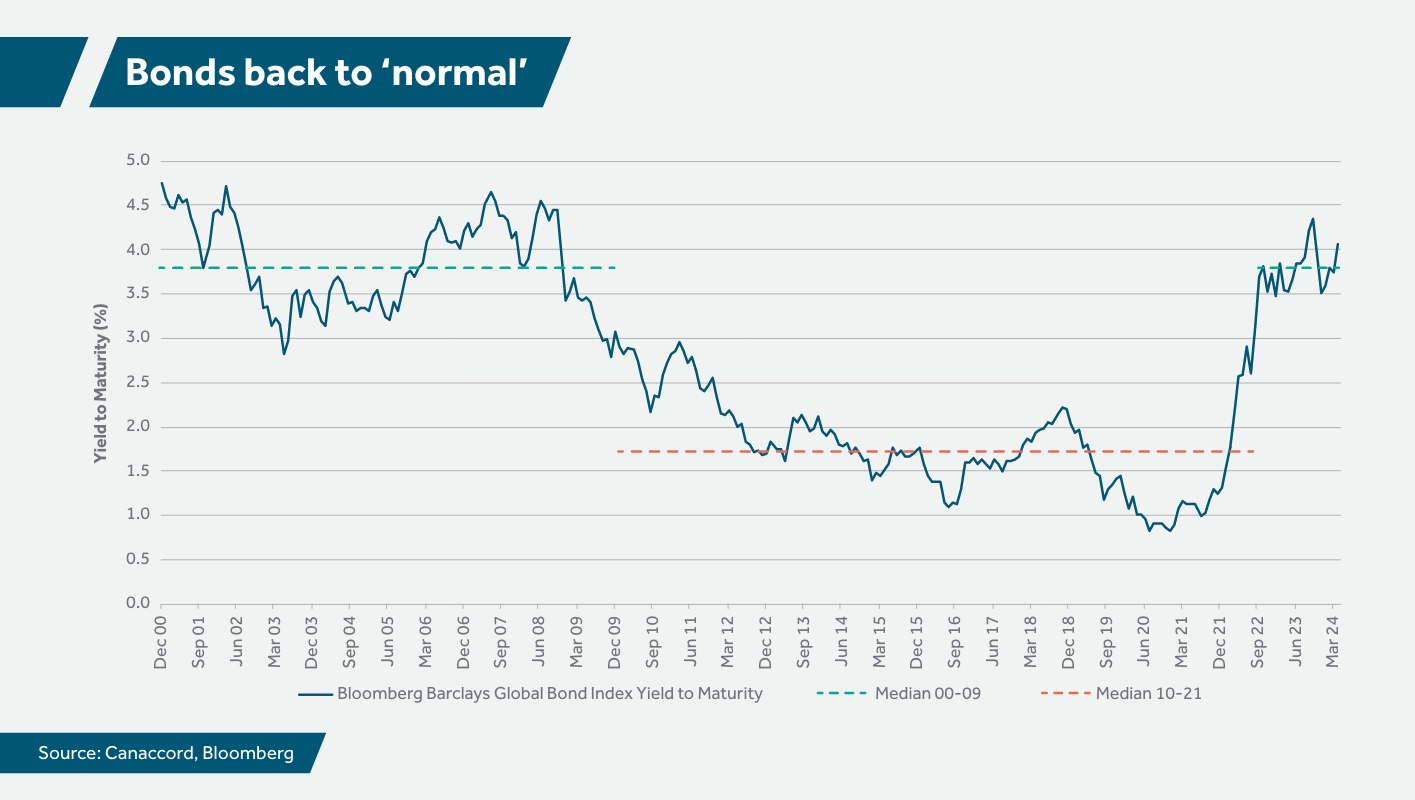

The bad year for fixed income in 2022 has represented a normalisation. Bonds offer attractive yields once again and are currently at levels not seen since the Global Financial Crisis (GFC), as shown on the graph below. Bonds can moderate equity risk whilst earning an attractive yield. 60/40 looks attractive once again.

Graph: This shows bonds back to ‘normal’. Source: Canaccord, Bloomberg.

However, we envisage that inflation is likely to be higher on average, more uncertain and volatile in the next decade or so. This is likely to lead to a more dynamic relationship between stocks and bonds – one in which bouts of high and rising inflation could result in periods of pain for equities and bonds simultaneously.

A modern approach to portfolio construction

A new asset allocation should be considered to strike the optimal balance in this new correlation regime. Investors must be more flexible and active in their approach when adapting portfolios for prevailing conditions. Investments that perform well during periods of inflation when traditional stocks and bonds become correlated should be part of a new optimal balance. These examples are key pieces on our chess board today:

Asset-backed securities (ABS): ABS generally have floating interest rates, which can be beneficial during inflationary periods. Floating rates adjust based on a reference interest rate. When inflation rises, central banks increase rates and the interest payments from floating-rate-ABS increase. In addition, ABS are collateralised: their value is derived from, (or ‘backed’ by), a specified pool of underlying assets. In an inflationary environment, the value of the underlying assets may increase.

Inflation-linked bonds: These are bonds in which the principal is tied to a specific inflation index. As inflation rises, the principal of these bonds increases. We prefer short-dated US Treasury Inflation-Protected Securities (TIPS) to limit our interest rate risk and provide sensitivity to the inflation component.

Commodities: Commodities like gold, oil, and agricultural products often benefit during inflationary periods. This is because demand for commodities tends to be strong during inflationary periods. The cost of the factors of production (e.g. labour and raw materials) that go into these commodities also goes up with inflation.

Commodity related equities: These are companies that are involved in the production, processing, or trading of commodities. For example, gold mining companies are a type of commodity-related equity. The performance of these companies is often closely tied to the price of the commodity they deal with. In an inflationary environment, as the price of commodities like gold increases, these companies can see increased profitability, which can lead to a rise in their stock price. We prefer gold miners as they are currently undervalued relative to the price of gold.

Liquid alternative strategies: These strategies involve investments that are not correlated with traditional stock or bond markets. They can provide a hedge against inflation because they have the potential to increase in value independently of traditional markets. Trend following, a type of managed futures strategy, can capitalise on the continuance of an existing market trend. It involves going long assets showing upward-trending prices and short those with downward-trending prices. In inflationary environments, markets often exhibit strong trends.

Ultimately, the key to successful investing, much like chess, lies in the ability to understand changes and adapt. Canaccord Genuity Wealth Management’s aim is to maintain a well-rounded portfolio that can withstand uncertainty. By considering a broader range of investment options and maintaining flexibility, we can adapt our portfolios to give us a positional advantage ensuring resilience and opportunity in the face of this new environment.

If you think you could benefit from the information in this article, please get in touch.

For further information on any of the terms used in this article please see our glossary of investment terms.

Find this information useful? Read more:

New to Canaccord Genuity Wealth Management?

If you are new to wealth management and would like to learn how this can benefit you, we can put you in touch with our team of experts that can help.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

This is not a recommendation to invest or disinvest in any of the companies, themes or sectors mentioned. They are included for illustrative purposes only.

The information contained herein is based on materials and sources deemed to be reliable; however, Canaccord Genuity Wealth Management makes no representation or warranty, either express or implied, to the accuracy, completeness or reliability of this information. Canaccord is not liable for the content and accuracy of the opinions and information provided by external contributors. All stated opinions and estimates in this article are subject to change without notice and Canaccord Genuity Wealth Management is under no obligation to update the information.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.