Wealth succession planning

How family succession planning could help protect your family’s future

Our independent wealth planners believe that wealth succession planning should be a key discussion point and incorporated into your financial plans as early as possible. However, they also realise that money can be one of the most awkward topics for many families to discuss, but happily this attitude seems to be changing.

Family wealth transfer - it’s time to talk money

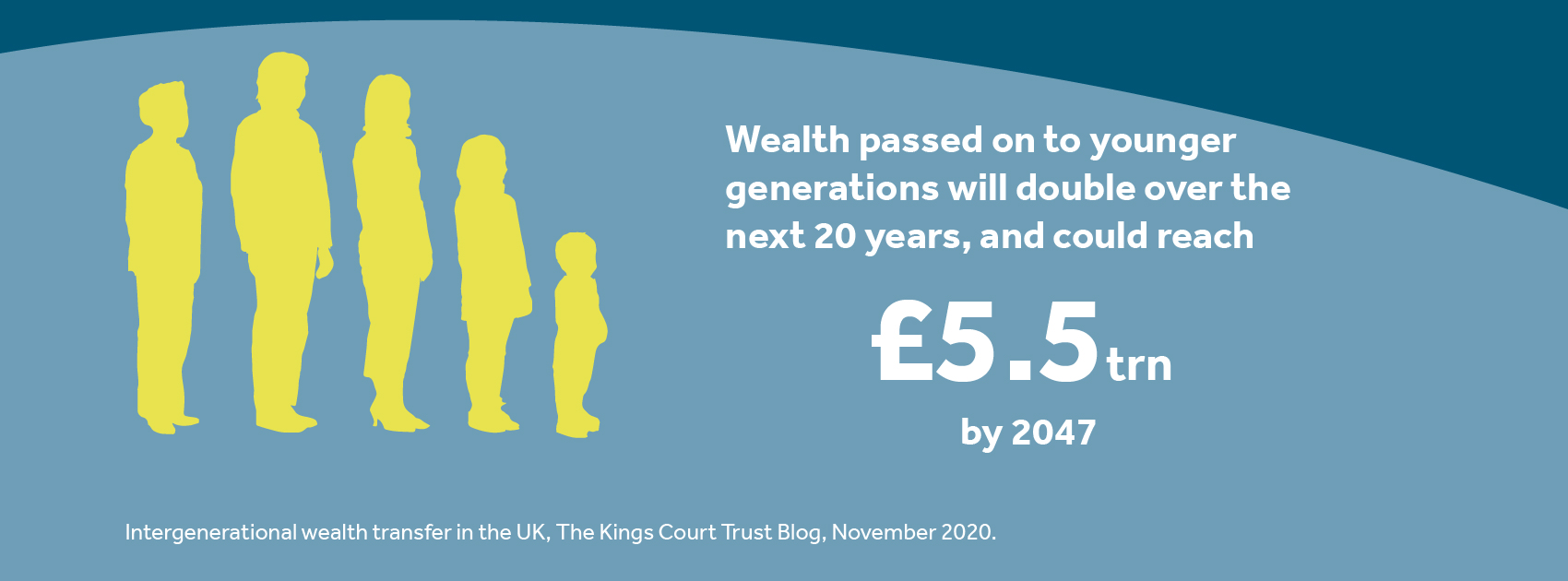

Even in the current economic climate, families are working hard to ensure they can leave as much of their estate as possible to their children and grandchildren, to ensure their financial stability in the future. In fact, it is believed that the amount of wealth passed on to younger generations could double over the next 20 years, possibly reaching as much as £5.5trn by 2047¹. Furthermore, a staggering £15bn inheritance is waiting unclaimed because people haven’t told their beneficiaries where their money is kept².

Having open and informed conversations between generations is an important way to ensure that your assets are handed down as simply and tax efficiently as possible, creating the best outcome for everyone. Together, your family can use succession planning to ensure your wealth is passed on as you wish.

However, before you start discussing things with your loved ones, consider these four key questions, all of which are interlinked.

- When do you want to transfer your wealth?

- How much wealth do you want to pass on?

- Who do you want to pass your wealth on to?

- How do you want to transfer your wealth?

Let’s look briefly at each question in turn.

1. When do you want to transfer your wealth?

This isn’t simply a question of leaving money in your Will. There are also ways of transferring assets during your lifetime, which may have a range of advantages.

Nevertheless, effective succession planning starts with ensuring that your Will is kept up to date, to reflect your personal circumstances and objectives. It should also reflect the latest legal thinking in the jurisdictions where you hold assets.

We suggest that you take professional legal advice, and we generally suggest that you review your Will every two to three years or whenever there is a major change in your or your family circumstances – such as marriage, divorce or the birth of a child or grandchild. For example, in England and Wales marriage revokes any existing Will, unless the Will was made in contemplation of the marriage.

We also suggest that you consider linking the value of any legacies to inflation, to ensure they maintain their ‘real’ value.

The main advantage of using your Will to transfer wealth is that you won’t compromise your own standard of living. On the other side of the coin, making gifts during your lifetime allows you to experience the joy of seeing your chosen beneficiaries benefiting from your funds. What’s more, if you are exposed to UK taxes, acting sooner rather than later can also be a more tax-efficient way to pass on your wealth to your loved ones.

While everyone’s priorities are different, it’s important to strike the right balance between sharing your wealth with your family and keeping enough to maintain your standard of living and make the most of life now and in the future. The last few years have been a jolt to us all, reminding us to expect the unexpected.

From a wealth planning perspective, in our view this means looking at various scenarios, and financially ‘stress testing’ the outcomes as part of cashflow planning. This includes, for example, testing against various investment return outcomes as well as inflation projections and potential long-term care costs.

2. How much wealth do you want to pass on?

Where larger gifts are being considered, this cashflow ‘stress testing’ can help you to make informed decisions by showing how much you can afford to give away during your lifetime, within a set range that allows for the worst and best case scenarios. This approach recognises that no one can accurately predict the future. After all, a year ago who was predicting double digit inflation in major economies?

3. Who do you want to pass your wealth on to?

This may be the easiest question to answer and is usually a very personal decision, often linked to the decision about timing. For example, if you have young grandchildren and your main priority is their long-term wellbeing, a trust structure might be an appropriate way forward; this could help with private education costs, university expenses or future property purchases.

Your trustees could have discretion over how much to distribute to the beneficiaries, when and to whom, within the terms of the trust deed. You could also keep some control by being a trustee yourself. This could be particularly relevant where one of your beneficiaries has special needs, as it can be designed to protect their long-term interests.

You might also like to consider benefiting charities close to your heart.

4. How do you want to transfer your wealth?

By following steps one to three , the ‘How?’ may well become clear. Timing plays a big part in this decision, as well as considerations around whether you can really afford to gift during your lifetime. If you can, you then need to decide whether to make absolute transfers or create a trust structure which, while adding complexity, may be the most effective way to achieve your objectives.

Talk to a wealth succession planning expert

Above all, it’s vital to start having conversations about the future with your loved ones. It’s also important to get the right balance between having enough capital and income to enjoy now, while passing on wealth to your family efficiently if you wish to do so.

Our independent wealth planning experts specialise in family succession planning and can advise all generations of your family, creating a joined-up approach that benefits everyone, working with existing legal or tax advisers where appropriate.

You may also be interested in:

- Cautious investment portfolios in volatile times

- Clean energy investments - why we need more climate optimism

- Inflation outlook – kill or cure?

- Investing in bonds to beat inflation

- Investing in turbulent times

Need more help?

Whatever your needs, we can help by putting you in contact with the best expert to suit you.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

This is not a recommendation to invest or disinvest in any of the companies, themes or sectors mentioned. They are included for illustrative purposes only.

The information contained herein is based on materials and sources deemed to be reliable; however, Canaccord Genuity Wealth Management makes no representation or warranty, either express or implied, to the accuracy, completeness or reliability of this information. Canaccord is not liable for the content and accuracy of the opinions and information provided by external contributors. All stated opinions and estimates in this article are subject to change without notice and Canaccord Genuity Wealth Management is under no obligation to update the information.

[1] fwu-report-final-version-20-april-2022.pdf (mandg.com)

[2] https://www.independent.co.uk/money/spend-save/inheritance-will-investment-pension-assets-life-insurance-a8927966.html

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.